On this page

Personal insolvencies increased in May 2023, according to new monthly provisional statistics released today by the Australian Financial Security Authority (AFSA).

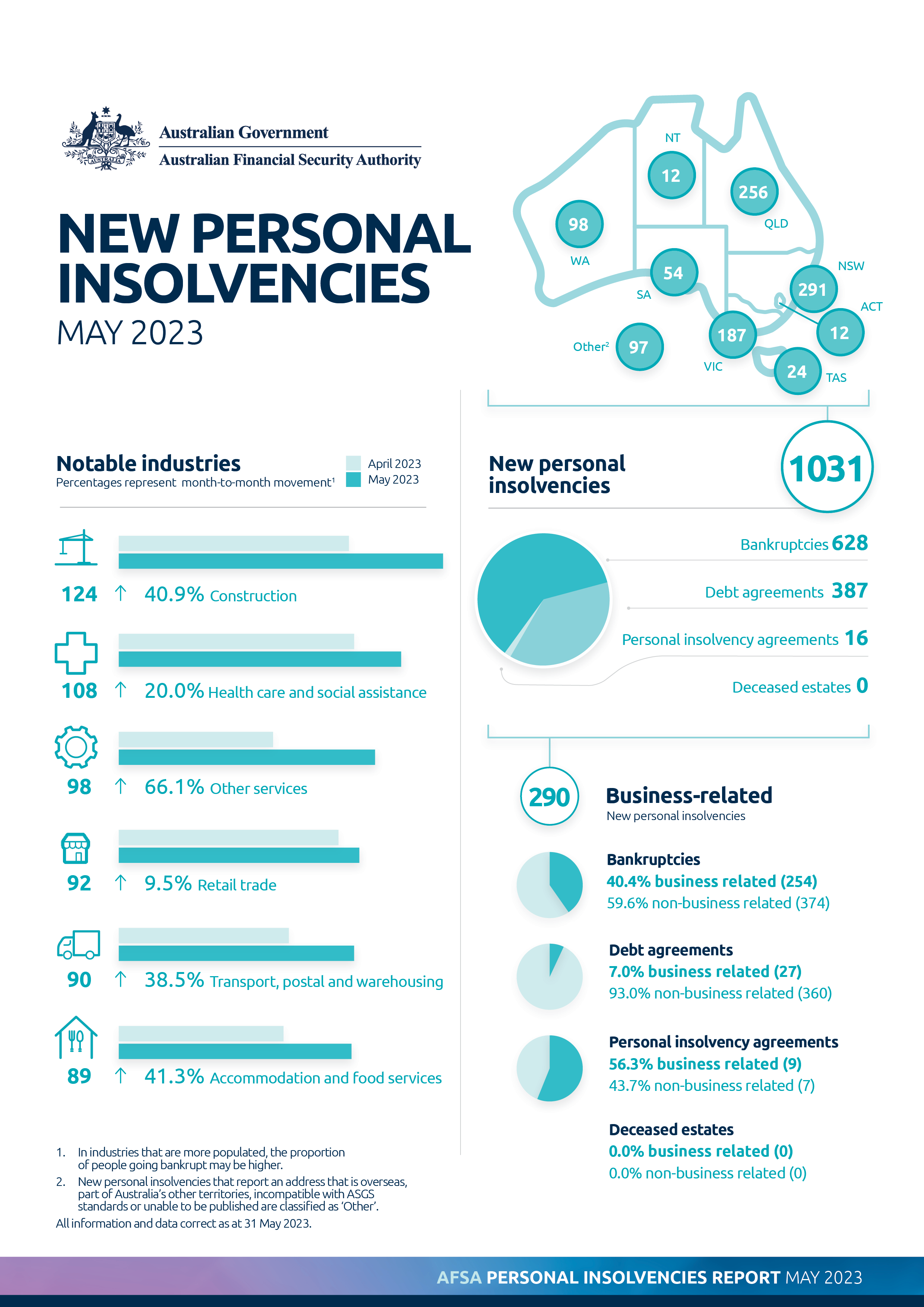

During May, there were 1,031 new formal personal insolvencies – up from 769 in April.

Of the new personal insolvencies, there were 628 bankruptcies, 387 debt agreements and 16 personal insolvency agreements. There were no deceased estates.

Where we could identify the industry an individual worked in, the most common industries were:

- Construction

- Health care and social assistance

- Other services

In May 2023, there were 19 new temporary debt protections.

Throughout the period, 290 people who entered a formal personal insolvency were also involved in a business – up from 198 in April.

Data provided in our monthly statistics is provisional and not final. For our final data, please see AFSA’s quarterly personal insolvency statistics.

People experiencing financial stress are encouraged to seek support early. Free confidential assistance is available through the National Debt Helpline.

If you’re facing serious unmanageable debt and considering formal insolvency options, reach out to a registered trustee or registered debt agreement administrator.

More information about our statistics is available at afsa.gov.au/statistics.