On this page

Australian Financial Security Authority Corporate Plan 2023–24

This Corporate Plan provides an understanding of our purpose, activities, operating environment and how we will measure our performance over the next 4 years. It outlines the factors that influence our work and planning, how we collaborate and engage with others, and our commitment to building our agency’s capabilities.

Download the AFSA Corporate Plan 2023-24

Message from the Chief Executive

I am pleased to present the Australian Financial Security Authority Corporate Plan 2023–24.

This plan covers reporting periods to 2026–27 and has been prepared in accordance with paragraph 35(1)(b) of the Public Governance, Performance and Accountability Act 2013.

Confidence in Australia’s personal insolvency and personal property securities systems is achieved by regulating firmly and fairly and providing world-class government services. These elements underpin our ambition to be a visible, modern and contemporary regulator, delivering economic and social outcomes.

Personal insolvency, personal property securities and criminal assets management play an important role in Australia’s $3.5 trillion credit system. The Australian Financial Security Authority’s role is significant. We oversee personal insolvency liabilities of $18 billion and the personal properties securities register which is used to secure $400 billion of personal property. We also assist in administering the proceeds of crime scheme that allows confiscated funds to be returned to the Australian community to prevent and reduce the harmful effects of crime in Australia.

This Corporate Plan provides an understanding of our purpose, activities, operating environment and how we will measure our performance over the next 4 years. It outlines the factors that influence our work and planning, how we collaborate and engage with others, and our commitment to building our agency’s capabilities.

Our agency is well positioned to build on our previous success, and I look forward to working with our people and our stakeholders to deliver value for the Australian community.

Tim Beresford

Chief Executive

Inspector-General in Bankruptcy

Registrar of Personal Property Securities

Snapshot

Our agency

The Australian Financial Security Authority (AFSA) is an executive agency in the Attorney-General’s portfolio.

Our purpose

To ensure confidence in Australia’s personal insolvency and personal property securities systems.

Our role

We are responsible for Australia’s personal insolvency, and personal property securities systems, and criminal assets management, which:

- provide Australian consumers and businesses with tools to manage financial risk

- contribute to investor and business confidence

- provide enhanced access to finance within the economy

- support the return of confiscated funds to the Australian community.

In delivering these services, we create an environment in which businesses and the community can properly assess financial risk and make informed financial decisions.

Personal insolvency and trustee services

Our role

If an individual is unable to pay their debts when they are due for payment, they are insolvent. Once a person becomes insolvent, they have a number of options available to them under Australia’s personal insolvency framework — the most well-known being bankruptcy. Other formal options include a debt agreement or a personal insolvency agreement.

AFSA’s role is to ensure the personal insolvency system operates in a way that:

- provides a fair and orderly process for sorting out the financial affairs of people that are unable to pay their debts

- allows clients to receive timely referrals, trustworthy advice and help that is tailored to their individual circumstances

- maximises returns to creditors

- quickly deals with those who seek to avoid their obligations and duties to others.

We do this through administration of bankruptcies, debt agreements, personal insolvency agreements, and regulation of industry professionals (bankruptcy trustees and debt agreement administrators).

Enabling legislation

We are responsible for administering the following Acts (and their associated regulations and rules):

- Bankruptcy Act 1966

- Bankruptcy (Estate Charges) Act 1997

We also manage confiscated assets in accordance with orders made under the Proceeds of Crime Act 2002 and other Commonwealth legislation.

| We fulfil the following roles created by the Bankruptcy Act 1966 (Bankruptcy Act): | |

|---|---|

| Inspector-General in Bankruptcy | Our Chief Executive is appointed to this role. The Inspector-General is responsible for the general administration of the Bankruptcy Act and has powers to investigate and report on any matter that relates to the administration of bankruptcies and the conduct of trustees in bankruptcy. |

| Official Receiver | Through the role of the Official Receiver, we operate a public bankruptcy registry service — the National Personal Insolvency Index (NPII) – and exercise coercive powers to assist bankruptcy trustees to discharge their responsibilities (such as helping trustees to gather information or recover assets). |

| Official Trustee in Bankruptcy |

This body corporate administers bankruptcies and other personal insolvency arrangements when a private trustee or other administrator is not appointed. We provide personnel and resources to ensure that the Official Trustee can fulfil its responsibilities. The Official Trustee also has responsibilities under the Proceeds of Crime Act 2002, the Proceeds of Crime Act 1987, the Mutual Assistance in Criminal Matters Act 1987, the Crimes Act 1914 and the Customs Act 1901 to control and deal with property under court orders made under those statutes (See Criminal assets management). |

Personal property securities system

Our role

The personal property securities system managed by AFSA includes the official government register of security interests in personal property (that is, property other than land, buildings, and fixtures to land) – the Personal Property Securities Register (PPSR). We also provide support for, and regulation of, those who use it. Security interests are created by an agreement where property can be taken a loan or other obligation is not repaid (secured finance) – this is particularly important in an insolvency, as registration on the PPSR establishes an order of priority for the recovery of assets or funds where there are competing interests.

The PPSR is a publicly available noticeboard, enabling people to identify whether a security interest is registered over personal property – something they should do before buying personal property or lending money to someone.

With more than 20 million registrations made since its inception in 2012, the PPSR functions to:

- increase the consistency and certainty of secured finance

- reduce the complexity and cost of secured finance

- enhance the ability of businesses and consumers to use their assets as security and improve their access to cost-effective finance.

Our role is to make sure that the PPSR is managed responsibly, available to use and contains information that is reliable.

Our aim is to make the system as accessible and useable as possible – particularly for those at risk of harm – as well as to reduce non-compliance through information and education, streamline our services to minimise regulatory burden, and take action to address and deter misuse.

Enabling legislation

We are responsible for administering the following Act (and associated regulations and rules):

- Personal Property Securities Act 2009

| We fulfil the following role created by the Personal Property Securities Act 2009 (PPS Act): | |

|---|---|

| Registrar of Personal Property Securities (Registrar) | Our Chief Executive serves in this role. The Registrar maintains the Personal Property Securities Register (PPSR) in compliance with the Act and associated regulations. This includes responsibility for ensuring that the register is operational and accessible. The Registrar has various powers in relation to the PPSR, such as refusing access to the PPSR or suspending its operation in certain circumstances; removing or reinstating data on the PPSR; and conducting investigations into matters for the purpose of performing their functions. |

Criminal assets management

Our role

The Proceeds of Crime Act 2002 establishes a scheme to confiscate proceeds of crime and allows for confiscated funds to be used to benefit the community. Through the Official Trustee in Bankruptcy, AFSA plays an important role in the Governments work to disrupt and dismantle organised crime. Working alongside the Australian Federal Police and other agencies, the Official Trustee manages restrained assets, sells confiscated assets, and controls the Confiscated Assets Account on behalf of the Commonwealth.

We act in a way that delivers the greatest value possible at the point of disposal (or return) of confiscated assets. Funds collected through this process are accessed by the Government to reinvest in local crime prevention, law enforcement, drug treatment and diversionary measures across Australia.

Enabling legislation

Our role is defined by the following Act (and associated regulations and rules):

- Proceeds of Crime Act 2002

Our key activities

Our core business is both regulation and service delivery. We ensure confidence in Australia’s personal insolvency and personal property securities systems by regulating firmly and fairly and providing world-class government services.

Our key activities incorporate the Ministerial Statement of Expectations and are aligned with AFSA’s Statement of Intent. The three principles of regulator best practice (continuous improvement and building trust, risk based and data driven, and collaboration and engagement) are foundational to our agency’s regulatory posture, inform our key activities and will be reported on in our Annual Performance Statements.

Regulating firmly and fairly

Regulators face inherent conflict in their objectives and in their client and stakeholder needs, yet maintaining a balanced system is one of the most important aspects of good regulation, confidence and integrity. AFSA’s most substantial responsibility is to consider the needs of individuals with unmanageable debt alongside the need to provide recourse for those who are owed money.

For our regulated professionals, we have a role in providing support so they can work effectively and efficiently while also ensuring that they do the right thing. Operationally, our resources are proportionately directed toward providing support for vulnerable or at-risk clients while monitoring for and taking decisive action against those that misuse our systems. Striking the right balance between the need for compliance and our duty to reduce administrative regulatory burden are front of mind in all that we do.

Regardless of their relationship to AFSA, the people and organisations we deal with will experience fairness and transparency in our communications and decision making.

As a regulator we will:

- maintain independence

- listen to client and stakeholder feedback

- adopt of Australian and international regulator best practice

- exercise common sense, empathy and respect

- make compliance the easiest option

- provide clear and transparent processes that provide consistency for users, but accommodate new or unique circumstances

- use our voice to advocate for system changes that benefit clients and stakeholders.

How we will do this

| 2023-24 | 2024-25 | 2025-26 | 2026-27 | |

|---|---|---|---|---|

| Articulate a Regulatory Strategy and develop related frameworks and action plans | radio_button_unchecked | radio_button_unchecked | radio_button_unchecked | radio_button_unchecked |

| Implement a contemporary regulatory approach | radio_button_unchecked | radio_button_unchecked | radio_button_unchecked | radio_button_unchecked |

| Build on our brand and stakeholder equity | radio_button_unchecked | radio_button_unchecked | radio_button_unchecked | radio_button_unchecked |

Our performance in regulating firmly and fairly is measured through the following performance measures: Minimising harm, Managing compliance and promoting awareness, and Influencing behaviour (see our performance).

Providing world-class government services

AFSA provides a range of services, including information, advice and administration, to the public on behalf of the Australian Government. We take a client-centred approach that combines industry knowledge, legal and financial acumen, and technology to deliver the right services, at the right time, and through the right channels.

Our clients can expect that our services are accessible, that our staff act professionally, that they will be respected, and that their data is safe. We have appropriate processes in place to support clients that may be experiencing hardship, vulnerability, or distress when they deal with our website, our service centre and our systems.

AFSA’s approach to service delivery seeks to understand and anticipate client, customer and stakeholder needs, improve our reputation and encourage the public to engage with our services early and often. Our focus in the year ahead will be on articulating how our regulatory approach is practically executed and translated into service delivery.

As a service provider we will:

- maintain relevant expertise and capability

- undertake effective consultation and communications

- ensure availability of self-service information and tools

- design accessible services that increase comprehension and efficiency

- provide secure services and data management

- take accountability for what we say and do.

- create capacity to respond to emerging challenges and needs of clients and stakeholders

How we will do this

| 2023-24 | 2024-25 | 2025-26 | 2026-27 | |

|---|---|---|---|---|

| Modernise our core business systems and implement new ways of working using a fit for purpose cloud platform | radio_button_unchecked | radio_button_unchecked | radio_button_unchecked | radio_button_unchecked |

Our performance in providing world-class government services is measures through the following performance measures: Effective and efficient services, Effective and efficient management of assets held by the Official Trustee, Timeliness of payment services, Quality information, and Online service availability (see our performance).

Our operating context

Our operating context comprises environment, capabilities, risk oversight and management, and cooperation.

Environment

Thinking about the future puts us in a better position to make decisions today. Over the next 4 years, we anticipate the biggest impacts to our operating environment that will influence achievement of our purpose will be:

Economic outlook

Global growth is expected to be at one of the lowest levels in 20 years as a result of high inflation, ongoing geopolitical and trade tensions, and COVID-19 aftermath. Uncertainty, stemming from major global events, is increasing in frequency and duration, as evidenced in recent years by the pandemic, the invasion of Ukraine and extreme weather events. More recently this has included instability in the global financial market, driven by failures of regional banks in the US and a global bank in Europe. Such challenges are expected to continue to contribute to uncertainty in Australian business and financial markets, adversely impacting domestic growth prospects, employment and credit growth. A weak economic environment has direct implications for personal insolvencies and PPSR activities. As such, AFSA will need to monitor trends that impact our operation, regulatory or service delivery approach.

Australia’s credit system profile

A large number of Australian households are currently experiencing financial stress due to cost-of-living pressures coming from rising interest rates, high inflation, supply chain pressures and elevated energy prices. It is likely to continue for the next 2 years, with the Reserve Bank expecting inflation to be back to its normal range sometime in 2025. The unemployment rate remains low, but the actual number of unemployed people is trending up, which, together with intensified financial stress and declining household saving buffers, contributes to rising insolvency risk. Although personal insolvencies have recently been at a historical low, they are expected to return towards the long-term average within the next 2 years as the impacts of COVID-19 stimulus are waning, more households are in financial difficulty and creditors increasingly pursue debts after a period of leniency. An increase in reliance on second-hand goods by budget-constrained consumers, rather than new, exposes them to additional risks relating to ownership and safety, possibly leading to more demand for PPSR searches.

Government reforms and focus

There is increasing momentum for a ‘root and branch’ review of Australia’s insolvency system and industry calls for a fundamental simplification of the design and drafting of insolvency law/s. At an Attorney-General’s roundtable in early 2023 key members of the industry, academics and AFSA executive discussed the potential improvements and impacts to the personal insolvency system. The recent Parliamentary Joint Committee on Corporations and Financial Services’ review on Corporate Insolvency in Australia recommended that as soon as practicable the government commission a comprehensive and independent review of Australia’s insolvency law, encompassing both corporate and personal insolvency.

AFSA continues to work with the Attorney-General’s Department on progressing remaining recommendations from the 2014 review of the PPS Act (Whittaker review) as appropriate.

Since 2019 AFSA has seen the value and complexity of criminal assets under its custody and control increase significantly. This is due to the intensive and targeted efforts of law enforcement agencies to identify and pursue criminal asset confiscation matters.

AFSA must therefore be a proactive, trusted voice to contribute meaningfully to discussions, and shape and respond to changes in our legislative environment. We utilise an environment and horizon scanning approach to maintain awareness of government, policy and legislative issues that may impact our purpose, our regulatory systems, our regulated population, or our clients.

Technological and digital advances

Every aspect of our lives and business is impacted by increasingly accurate, powerful, and capable technologies and digital advances. The pace of innovation and adoption of potentially disruptive emerging technologies is mounting year on year, without showing any sign of slowing. This presents AFSA with opportunities, risks and challenges in both regulation and service delivery.

Developments in artificial intelligence, machine learning and process automation provide opportunities to enhance and streamline our work in a positive way, however increasing cybersecurity threats that utilise the same technology must also be considered.

The rise of new digital assets like cryptocurrency and non-fungible tokens, are relevant to the personal insolvency system, criminal assets management and the PPSR. As a regulator, AFSA will be required to lead the way in understanding how these affect debtors and creditors, and subsequently, the provision of advice and education to relevant stakeholders.

Competition for talent

There has already been a significant shift in the world of work, which will continue to accelerate in future years. Ongoing employment market volatility is creating talent supply shortages and higher salary expectations, which is impacting the availability and turnover of skilled workers in the APS. There is increasing pressure for employers to offer a compelling employee value proposition, including greater flexibility and mobility options.

Consideration will need to be given to changing work patterns and engagement types, shifts in demographics of employees and the integration of new technologies such as artificial intelligence. AFSA’s recruitment practices, human resources policies and workplace culture will be consciously designed to attract and nurture a workforce that is curious, inclusive, and diverse.

Capabilities

Our capability is underpinned by our people and data and technology. Over the next 4 years we will invest in initiatives that ensure AFSA is equipped to deliver its purpose and advance its vision.

Our people

People are at the heart of everything we do. The achievement of AFSA’s ambitious strategic direction will only be possible with the right organisational capability and people skills. Our recent Capability Review identified that we need to prioritise building our workforce capability and developing a data-driven culture with improved accountability.

Development of a Strategic Workforce Plan will focus on talent management and holistic capability development including technical knowledge, data literacy and leadership skills. In the immediate term we will focus on practical solutions to slow turnover and retain and maintain technical and corporate knowledge.

Achievement of our purpose is underpinned by AFSA’s leadership and culture. AFSA is committed to initiatives that support psychological safety, foster a learning culture, and support people to bring their whole selves to work. Investing in leadership extends well beyond the executive team and will focus on developing people leaders at all levels in the agency.

How we will do this

| 2023-24 | 2024-25 | 2025-26 | 2026-27 | |

|---|---|---|---|---|

| Address our future talent needs through development and implementation of a Strategic Workforce Plan | radio_button_unchecked | radio_button_unchecked | radio_button_unchecked | radio_button_unchecked |

| Cultivate a data culture, including implementation of a Data and Analytics Strategy | radio_button_unchecked | radio_button_unchecked | radio_button_unchecked | radio_button_unchecked |

| Uplift management and leadership capability | radio_button_unchecked | radio_button_unchecked | radio_button_unchecked | radio_button_unchecked |

| Articulate and embed contemporary organisational values | radio_button_unchecked | radio_button_unchecked | radio_button_unchecked | radio_button_unchecked |

Data and technology

AFSA is undergoing significant technological transformation that is expected to continue at the same pace into the future, to support our goals. Our initial focus is on replacing outdated technologies and systems to ensure that our staff can work more efficiently, to improve client experience and ensure continuity of services. We will then move to enhancements that advance our regulatory effectiveness through technologies that make compliance easier, new surveillance and enforcement tools, enhanced data and analytics capability and increased cyber security.

How we will do this

| 2023-24 | 2024-25 | 2025-26 | 2026-27 | |

|---|---|---|---|---|

| Develop and implement a Technology Strategy to support the agency’s strategic direction | radio_button_unchecked | radio_button_unchecked | radio_button_unchecked | radio_button_unchecked |

| Invest in data and analytics technologies | radio_button_unchecked | radio_button_unchecked | radio_button_unchecked | radio_button_unchecked |

| Continuously improve our approach to cyber security | radio_button_unchecked | radio_button_unchecked | radio_button_unchecked | radio_button_unchecked |

Risk oversight and management

Effective risk management is a priority for AFSA, and we are committed to embedding meaningful conversations and effective mitigation at all levels of the agency.

Our agency utilises the ‘Critical Control Approach’ to manage its strategic risks; a methodology which aims to reduce the complexity of managing risk by focussing on identifying key risk controls (known as ‘Critical Controls’) and using evidence to assess the effectiveness of these controls.

This approach allows AFSA to manage the complex details of strategic risks, in a simplified way, and facilitates a reduction in the overall number of risks across the agency.

By using this approach and managing fewer risks more comprehensively, AFSA seeks to ensure risk management at AFSA is simple, informed, and meaningful.

Our risk management framework and assurance strategy describe the relationship between controls, management oversight mechanisms and independent assurance. We have built comprehensive controls and oversight mechanisms, allowing us to readily identify and manage control gaps and gain assurance that controls are operating as intended.

Our strategic risks are:

| Strategic risk | Why is this a risk? | How do we manage this risk? |

|---|---|---|

| Sudden change in demand or supply |

A sudden change in demand or supply in the personal insolvency sector may impact access to insolvency practitioners’ services, impact the preservation of knowledge and expertise or reduce competition. It is critical to be able to maintain a sustainable insolvency sector, whilst ensuring that only those with suitable qualifications, experience and skills enter the market. |

For both personal insolvency and personal property securities, we actively monitor and analyse demand and supply data, and maintain the capacity to direct work to those best placed to do it. We foster a professional and sustainable insolvency sector by maintaining high standards of practitioner entry screening and providing ongoing guidance. |

| Regulatory failure | Without effective regulation, we would be unable to safeguard against financial loss for creditors, protect debtors against poor advice, support effective relief from unmanageable debt, or maintain the reliability of the Personal Property Securities Register. | We foster client and stakeholder confidence by ensuring high national standards of personal insolvency practice, and compliance with the Bankruptcy Act and Personal Property Securities Act. We regularly review our regulatory approach and operations to ensure we are regulating in areas where we need to, and not over or under regulating in areas that we do regulate. This is supported by robust processes for registering, inspecting and assessing practitioners through our compliance program. |

| Control and/or quality of data is compromised through incorrect or unauthorised data entry, access, use or release | AFSA is a trusted guardian of a range of data we collect from those who use our services. Losing control of our data can compromise clients’ identity and privacy, undermine their trust in government, or put them at an economic disadvantage. | We aim to ensure that our information assets remain secure, accurate and consistent by applying appropriate security and quality processes across the data cycle. |

| Users of our services are unable to make informed decisions | Failure to preserve the integrity of the personal insolvency and personal property securities systems harms the Australian community’s confidence that these systems operate fairly and in accordance with the law. Uninformed decision-making can undermine the chance of debtors and creditors achieving favourable outcomes. | We ensure the processes and systems we use to administer the Bankruptcy Act 1966 and Personal Property Securities Act 2009 remain relevant, secure and responsive to the needs of the community. We devote resources to effectively regulate the personal insolvency practitioner sector and actively engage with our stakeholders. This includes ensuring we have robust technologies, efficient processes and a professional workforce to deliver our services. |

| Service delivery failure | Our clients and stakeholders expect our services to be secure, accessible, convenient, reliable and high performing. Failure to maintain service capacity harms the ability of clients to make informed decisions and impacts sustainable credit flow within the Australian economy. | We regularly review our business processes and online services to provide an improved and secure client experience. We also continue to leverage our strong stakeholder relationships and a client-centred approach to manage expectations, promote compliance, design and deliver strategies to improve the client experience and meet client needs, and promote open access to our services. |

Cooperation

Like many other regulators, we rely on cooperation with a broad range of stakeholders and interested parties to be able to deliver on our purpose.

Government

The strength of Australia’s credit system requires various regulators to work together, share data, and collaborate on initiatives that contribute to economic and social outcomes. We can also draw insights and best practice examples from other agencies as we seek to be a visible, modern, and contemporary regulator. AFSA is committed to contributing to government-led initiatives and is a member the Phoenixing Taskforce, the Criminal Assets Confiscation Taskforce, the Federal Regulator Agencies Group, the National Regulators Community of Practice and more.

We have a strong history of cooperation and working with a range of regulators including the Australian Taxation Office, Australian Securities and Investments Commission, Australian Competition and Consumer Commission and the Australian Federal Police. These relationships enable our agencies to align our key priorities, increase mutual assistance, and maximise the effectiveness of inter-agency collaboration.

We have a renewed focus on increasing our engagement with government in the years ahead. In particular, we will concentrate on how AFSA’s insights can be harnessed to deliver improvements to policy and program design and delivery to achieve early intervention or reduced harm for those at greatest risk of personal insolvency. This includes establishing or strengthening relationships with the Australian Financial Complaints Authority, the Department of Social Services and the Office for Women.

Industry

Our relationships with industry are vital to our ability to regulate effectively and efficiently. We engage with industry associations, major creditors, registered trustees, registered debt agreement administrators, financial counsellors, and legal professionals to exchange feedback, expertise, and resources. We hold regular forums, send newsletters, and meet directly with individuals and organisations. We pride ourselves on our personal relationships and accessibility, engagement, and provision of timely resources, data and insights and seek to strengthen these.

Policy and subject matter experts

Experts and academics are a valuable source of data and insights that support AFSA’s strategy and decision-making. This is enabled by AFSA’s commitment to collaboration with the research sector to extend the value of public data for the benefit of the Australian people. We work closely with specialists across a range of topics and play a role in connecting industry with experts.

Other

AFSA regularly connects with insolvency regulators in comparative jurisdictions such as the United Kingdom and New Zealand and is an active member of the International Association of Commercial Administrators, the International Association of Insolvency Regulators and the International Association of Restructuring, Insolvency & Bankruptcy Professionals. Within Australia, we work with various federal and state government departments that oversee social and economic policies and programs that relate to the credit system, our stakeholders, and our clients. We also ensure that we are connected with various not-for-profit and community groups that our clients interact with before or after they deal with us.

Our performance

Our performance measures tell the Government and the Australian public how our performance in achieving our purpose will be measured and assessed. AFSA is committed to continuous improvement and is taking active measures to evolve the quality of our performance measures, including the development of a new suite of performance measures to be implemented in 2024-25.

Regulating firmly and fairly

| Measure | Minimising harm | |||

|---|---|---|---|---|

| Description | Create an environment that minimises harm caused by significant non-compliance with the law or a failure by the regulated community to act in accordance with an expected standard of behaviour. | |||

| Rationale | As a regulator, we measure our performance on our ability to create an environment that minimises harm caused by significant non-compliance, which assists our stakeholders and clients to have confidence in our regulatory approach to Australia’s personal insolvency and personal property securities systems. We want to ensure that we deliver firm and fair compliance outcomes. | |||

| Methodology |

We measure this by:

|

|||

| Data source |

We use:

|

|||

| Target | 2023-24 | 2024-25 | 2025-26 | 2026-27 |

| Firm and fair compliance outcomes | ||||

| Measure | Managing compliance and promoting awareness | |||

|---|---|---|---|---|

| Description | Proactively apply appropriate regulatory, enforcement and other actions to encourage compliance and address non-compliance. | |||

| Rationale | As a regulator, we measure our performance on our ability to apply appropriate regulatory enforcement to encourage compliance and address non-compliance. | |||

| Methodology |

We measure this by:

|

|||

| Data source |

We use:

|

|||

| Target | 2023-24 | 2024-25 | 2025-26 | 2026-27 |

| Effective action taken to manage compliance | ||||

| Measure | Influencing behaviour | |||

|---|---|---|---|---|

| Description | Effectively influence stakeholders to act in accordance with expected standards of behaviour | |||

| Rationale | As a regulator, we measure our performance on our ability to influence behaviour. We want our stakeholders and clients to operate in accordance with expected standards of behaviour. | |||

| Methodology |

We measure this by:

|

|||

| Data source |

We use:

|

|||

| Target | 2023-24 | 2024-25 | 2025-26 | 2026-27 |

| Effective action taken to respond to emerging issues and improve the understanding of compliance responsibilities | ||||

Providing world-class government services

| Measure | Effective and efficient services | |||

|---|---|---|---|---|

| Description | Enhance digital services to improve the client experience and drive operational efficiency | |||

| Rationale | In providing world-class government services, we want to ensure that we deliver those services effectively and efficiently. As we enhance and digitise our services, we want to make sure that we are improving the experience of our clients, reducing the regulatory burden, making efficiencies in our operations, and delivering the right outcomes. | |||

| Methodology |

We measure this by:

|

|||

| Data source |

We use:

|

|||

| Target | 2023-24 | 2024-25 | 2025-26 | 2026-27 |

| Improved client satisfaction and reduced effort | ||||

| Measure | Effective and efficient management of assets held by the Official Trustee | |||

|---|---|---|---|---|

| Description | Effectively and efficiently manage assets and cash held in trust for beneficiaries throughout the asset life cycle in accordance with relevant legislation, directions and guidance. | |||

| Rationale | In providing world-class government services, we want to ensure the effective and efficient management of assets and cash held by the Official Trustee to maximise the return to beneficiaries. In line with the cost recovery arrangements that we operate under, we want to ensure that we deliver value to clients and stakeholders in a commercially sound manner, which includes protecting and securing the assets we hold. | |||

| Methodology |

We measure this by:

|

|||

| Data source |

|

|||

| Target | 2023-24 | 2024-25 | 2025-26 | 2026-27 |

| Effective action taken to maximise return on assets | ||||

*Case studies will be selected based on pre-determined and documented criteria and assessed against effectiveness and efficiency criteria to determine performance results.

| Measure | Timeliness of payment services | |||

|---|---|---|---|---|

| Description | Proportion of distributions to creditors paid within 3 months of last receipt of money. | |||

| Rationale | In providing world-class government services, we want to ensure that we process distribution of bankrupt estates as efficiently and effectively as possible. We aim to distribute funds to creditors in a timely manner and have set ourselves a target of making 80% or more of payments within 3 months of the last monies being received. | |||

| Methodology |

We calculate this as: NDP/TNDP NDP = the number of dividends paid in the reporting period TNDP = the total number of dividends paid in the same period |

|||

| Data source |

|

|||

| Target | 2023-24 | 2024-25 | 2025-26 | 2026-27 |

| ≥ 80% | ||||

| Measure | Quality information | |||

|---|---|---|---|---|

| Description | Provide accessible, accurate, relevant and easily understood information in a timely way. | |||

| Rationale | In providing world-class government services, we want our stakeholders and clients to be aware of their options, make informed decisions, and be compliant when they engage with our services. We need to ensure we provide our clients with information that is easily accessible, accurate, relevant and easy to understand so they have all the information they need on our services to assist them in making informed decisions. | |||

| Methodology |

We measure this by:

|

|||

| Data source |

We use:

|

|||

| Target | 2023-24 | 2024-25 | 2025-26 | 2026-27 |

| Effective action taken to digitise and improve information services | ||||

| Measure | Online service availability | |||

|---|---|---|---|---|

| Description | Percentage of time that externally facing online insolvency services and personal property securities register are available. | |||

| Rationale | In providing world-class government services, we assess our performance in providing online services. The reliable operations and availability of our online systems and registries are an indicator of our ability to build and foster confidence in our online services and products. We closely monitor the availability of our online services to ensure we can respond to any issues that may impact their availability. | |||

| Methodology |

We calculate this by:

|

|||

| Data source |

We use:

|

|||

| Target | 2023-24 | 2024-25 | 2025-26 | 2026-27 |

| ≥ 99% | ||||

* A new monitoring tool that replicates actual user interactions to determine availability statistics will be introduced in 2023-24. This will be reported on in the Annual Performance Statements.

Further information on Our Performance is included in Appendix 1.

Appendix 1 – Our performance

This appendix provides further information about how we measure our performance.

All of the performance measures listed in the Corporate Plan (with the exception of Timeliness of payment services) comprise 2 or more sub-measures, which are reported on by different sections of our agency.

The tables below provide further information on sub-measures and our alignment with requirements of section 16EA of the Public Governance, Performance and Accountability Rule and the principles of regulator best practice:

Regulating firmly and fairly

| Measure | Minimising harm |

|---|---|

| Program(s) | 1.1 & 1.2 |

| Number of sub-measures | 4 |

| Contributing functions | Enforcement; Personal Property Securities Program; Compliance; Estate Administration |

| Qualitative / Quantitative | Qualitative |

| Output / Efficiency / Effectiveness | Output, Effectiveness |

| Regulator performance principle(s) |

Continuous improvement and building trust |

| Measure | Managing compliance and promoting awareness |

|---|---|

| Program(s) | 1.1 & 1.2 |

| Number of sub-measures | 2 |

| Contributing functions | Enforcement; Personal Property Securities Program |

| Qualitative / Quantitative | Qualitative |

| Output / Efficiency / Effectiveness | Output |

| Regulator performance principle(s) |

Continuous improvement and building trust |

| Measure | Influencing behaviour |

|---|---|

| Program(s) | 1.1 & 1.2 |

| Number of sub-measures | 4 |

| Contributing functions | Practitioner Surveillance; Estate Administration; Strategic Communications; Personal Property Securities Program |

| Qualitative / Quantitative | Qualitative |

| Output / Efficiency / Effectiveness | Output |

| Regulator performance principle(s) |

Continuous improvement and building trust |

Providing world-class government services

| Measure | Effective and efficient services |

|---|---|

| Program(s) | 1.1 & 1.2 |

| Number of sub-measures | 5 |

| Contributing functions | Practitioner Surveillance; Personal Property Securities Program; Compliance; AFSA Service Centre; Government Engagement |

| Qualitative / Quantitative | Qualitative, Quantitative |

| Output / Efficiency / Effectiveness | Output |

| Measure | Effective and efficient management of assets held by the Official Trustee |

|---|---|

| Program(s) | 1.1 |

| Number of sub-measures | 2 |

| Contributing functions | Criminal Assets Management; Estate Administration |

| Qualitative / Quantitative | Qualitative |

| Output / Efficiency / Effectiveness | Output, Effectiveness |

| Measure | Timeliness of payment services |

|---|---|

| Program(s) | 1.1 |

| Number of sub-measures | 0 |

| Contributing functions | Estate Administration |

| Qualitative / Quantitative | Quantitative |

| Output / Efficiency / Effectiveness | Efficiency (Proxy)* |

* Efficiency is generally measured as a cost to output ratio; however AFSA uses a timeliness measure due to the nature of its business. The Official Trustee generally administers cases with low realisations, higher levels of complexity or increased public interest. Due to the unique nature of these cases, we don’t currently measure cost of administration. Accordingly, we use timeliness of payment services (how quickly we provide returns to creditors) as a proxy measure for efficiency.

| Measure | Quality information |

|---|---|

| Program(s) | 1.1 & 1.2 |

| Number of sub-measures | 4 |

| Contributing functions | Personal Property Securities Program; Practice & Insights; Strategic Communications; Strategic Analytics |

| Qualitative / Quantitative | Qualitative |

| Output / Efficiency / Effectiveness | Output |

| Measure | Online service availability |

|---|---|

| Program(s) | 1.1 & 1.2 |

| Number of sub-measures | 2 |

| Contributing functions | Business Applications (for Personal Insolvency systems); Personal Property Securities Program |

| Qualitative / Quantitative | Quantitative |

| Output / Efficiency / Effectiveness | Output |

Changes in our performance information

The following changes have been made since the 2022-23 Corporate Plan:

- We have updated our methodology to better reflect the method we use to consider our performance and moved sources of data to a new section titled Data source.

- ‘Timeliness of payment services’ was previously called ‘Payment services’, including in the Portfolio Budget Statement 2023-24. The measure details remain the same.

- The Annual Regulatory Plan was previously known as the annual Compliance Program.

How we measure and report on our performance

Assessing sub-measure performance

We assess our performance at the sub-measure level using ‘Achievement Criteria’ and targets that demonstrate how each section of our agency contributes to the overall performance measure and target. At the end of the reporting period our performance is assessed against each Achievement Criteria, and an overall sub-measure result is given as:

We provide a level of judgement in this assessment, giving consideration to weighting, relative resourcing, and impact/outcome.

Composite measure methodology

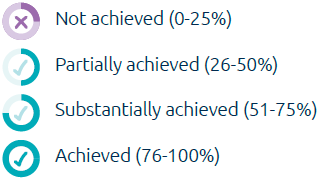

Overall results for performance measures are calculated using a scoring system, where all sub-measures have equal weighting. We look at the total results achieved for sub-measures (assigning 0 for Not achieved, 1 for Partially achieved and 2 for Achieved) and divide this by the maximum possible result (determined as the number of sub-measures x 2). This gets converted into a percentage, and reported using the below results:

Quality assurance

We undertake regular quality assurance checks throughout the year to ensure that our results are accurate and that we maintain appropriate records. Our Corporate Performance Framework was also reviewed by Internal Audit in 2023, which has informed our approach to performance reporting for 2023-24.

Where we report on our performance

We will report on the above performance measures in our Annual Performance Statement, contained within our Annual Report. This will include the actual results that we achieved, in comparison to our target for each performance measure, in addition to an analysis of our performance and the contributing factors.

We also regularly report insolvency statistics and publish insights that help the public to better understand personal insolvencies in Australia and the operation of the PPSR. These can be found at https://www.afsa.gov.au/about-us/statistics

Appendix 2 - List of requirements

AFSA’s Corporate Plan has been prepared in accordance with the requirements of section 35 of the Public Governance, Performance and Accountability Act 2013, sections 16E and 16EA of the Public Governance, Performance and Accountability Rule, and Resource Management Guide 132 (Corporate plans for Commonwealth entities).

| Requirement | Section |

|---|---|

|

Introduction

|

Message from the Chief Executive |

| Purpose | Our purpose |

| Key activities | Our key activities |

| Operating context | Our operating context |

| Performance | Our performance |