On this page

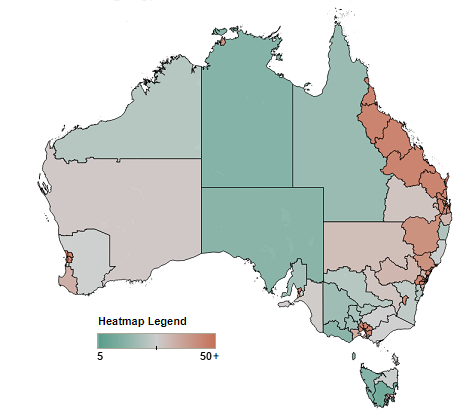

Note: Displayed by Statistical Area Level 4

The Australian Financial Security Authority (AFSA) released regional personal insolvency statistics for the June quarter 2020.

New personal insolvencies fell 21.6% in capital cities in the June quarter 2020 compared to the previous quarter. They fell in all capital cities except Greater Darwin. Over the June quarter 2020, new personal insolvencies also fell 17.7% in regions outside capital cities.

The number of new debtors involved in business fell in the June quarter 2020 compared to the previous quarter. These falls were widespread except in Rest of Western Australia and regions of relatively high socio-economic disadvantage in Greater Sydney. These regions in Greater Sydney include Fairfield, Mount Druitt, Merrylands – Guildford and Wyong.

There were also falls in the number of people who entered new personal insolvencies who were not involved in a business. These falls were widespread except in Greater Hobart and Rest of Western Australia. In Greater Hobart, there were rises in regions of relative low socio-economic disadvantage. These regions include Hobart – South and West and Hobart Inner. Areas of relative high socio-economic disadvantage fell including the regions Brighton and Hobart – North West. There were rises in Rest of Western Australia in areas with relatively high socio-economic disadvantage such as Kimberley.

The proportion of debtors in capital cities fell by 1.1 percentage points in the June quarter 2020 compared to the previous quarter to 64.0%.

June quarter 2020 regional personal insolvencies state by state

The Greater Sydney regions with the highest numbers of debtors entering personal insolvency were Campbelltown (NSW) (49), Penrith (43) and Wyong (41). In the rest of New South Wales, they were Tamworth – Gunnedah (29), Newcastle (23), Dubbo (20) and Tweed Valley (20).

The Greater Melbourne regions with the highest numbers of debtors entering personal insolvency were Wyndham (56), Casey - South (42) and Whittlesea - Wallan (39). In the rest of Victoria, they were Geelong (28), Ballarat (13) and Bendigo (12).

The Greater Brisbane regions with the highest numbers of debtors entering personal insolvency were Springfield - Redbank (47), North Lakes (35) and Narangba - Burpengary (34). In the rest of Queensland, they were Ormeau - Oxenford (68), Townsville (58) and Mackay (41).

The Greater Adelaide regions with the highest numbers of debtors entering personal insolvency were Salisbury (30), Onkaparinga (27) and Charles Sturt (24). In the rest of South Australia, they were Murray and Mallee (13) and Limestone Coast (12).

The Greater Perth regions with the highest numbers of debtors entering personal insolvency were Wanneroo (61), Rockingham (52), Gosnells (37), Stirling (37) and Swan (37). In the rest of Western Australia, they were Bunbury (24), Wheat Belt - North (13) and Goldfields (12).

The Greater Hobart region with the highest number of debtors entering personal insolvency was Hobart - North West (8). In the rest of Tasmania, it was Launceston (12).

The Greater Darwin regions with the highest numbers of debtors entering personal insolvency were Palmerston (14) and Darwin Suburbs (13). In the rest of Northern Territory, it was Alice Springs (7).

The Australian Capital Territory regions with the highest numbers of debtors entering personal insolvency were Tuggeranong (16) and Belconnen (11).