On this page

Speech by AFSA Chief Executive Tim Beresford at the 2023 Financial Counselling Australia (FCA) conference, Thursday 18 May.

Financial Counselling Australia Conference 2023: A Seat at the Table

Tim Beresford

Chief Executive, Inspector-General in Bankruptcy and Registrar of Personal Property Securities

Australian Financial Security Authority

Thursday 18 May 2023

Acknowledgement of Country

Good day, I’d like to begin with an acknowledgment to the traditional owners of the land on which we meet today, the Ngunnawal People and pay my respects to their elders past, present and emerging, and recognise the continued connection to their lands, their waters and their communities – and as we heard yesterday the beautiful view over Mount Ainslie and their continued stewardship of this land for over 65 thousand years.

Introduction

I am so pleased to be able to join you today at this year’s Financial Counselling Australia conference.

A Seat at the Table. In my mind this brings us together - our collective voice, our collective vision and our collective purpose to ensure we have a supportive system for people experiencing financial pressure and financial vulnerability.

Today I’m here to talk about bankruptcy but more than that personal insolvency and share with you the work that we have underway at the Australian Financial Security Authority (AFSA) and, our focus on supporting confidence in the Australian credit system through education, through compliance and through enforcement.

Importantly, I’m here to talk to you about how we can unlock the power of collaboration to work together to lift financial awareness and literacy and build an even more confident and capable system.

This month, I have just achieved or reached one year as the Chief Executive. My background is in banking, professional services, education and social and economic policy.

Outside our organisation, I am the chair of the Benevolent Society, Australia’s oldest, non-Indigenous, not for profit. The Benevolent Society was founded in 1813 in Surry Hills and the Benevolent Society has been working with vulnerable people for over 200 years.

It is the work at the intersection of delivering both social outcome and economic outcome that motivates me as the Chief Executive. In the past year, I’ve had the opportunity to speak to many stakeholders, many of you in this room, co-regulators, financial services and other not-for-profits.

To some, to many personal insolvency can be and is stark. It can be and is confronting to many.

But as you know only too well, financial hardship is an unwelcome reality for many Australians. It touches so many people’s lives, particularly, as you know only too well, with the rising cost of living, interest rates, inflation and many, many other economic pressures.

I have experienced that unwelcome reality firsthand in Surry Hills, when I participated in the ‘Day in the life of a Financial Counsellor’ program, through the Financial Rights Legal Centre (FRLC).

In our organisation, in my first week, I spoke to a staff member who had a call from a person considering self-harm.

Whilst in our organisation we are not counsellors, we advocate for trustworthy advice from trained financial counsellors and the National Debt Helpline.

So, we have a seat at your frontline table. And today, I want to invite you and talk to you about having a seat at the personal insolvency table with us.

Chapter 2 - Who we are and what we do – visible, modern and contemporary

I’m often asked as the CE, so what do you do? What does the Australian Financial Security Authority do?

Well in a nutshell, we’re a visible, modern and contemporary regulator, that is about supporting a strong credit system for Australia. And we do this through listening, learning and collaborating.

We administer three areas: personal insolvency which I will spend more time talking about today, the Personal Property Securities Register and criminal asset management.

As I’ve touched on, we deliver these three functions through education, compliance and enforcement.

We are a small to medium size Commonwealth agency and have a significant responsibility.

Within personal insolvency, we oversee and regulate over $18 billion of liabilities in the Australian credit system.

Just briefly to mention, we also maintain the Personal Property Securities Register, a noticeboard if you like, for personal property assets to be registered, a consumer protection. The value of the Personal Property Securities Register, or the value of assets on the Personal Property Securities Register is around $400 billon or about 20% of GDP.

And finally, we manage criminal assets; assets that have been captured through the proceeds of crime. At the moment we’re overseeing assets in the order of half a billion dollars.

Chapter 3 - State of the Personal Insolvency system

Let me turn to personal insolvency. When we look at the current state of play of personal insolvency, we look at it through three lenses.

We look at it through a debtor lens, a creditor lens and clearly the practitioner and key stakeholders that shape and influence both debtor and creditor conversations.

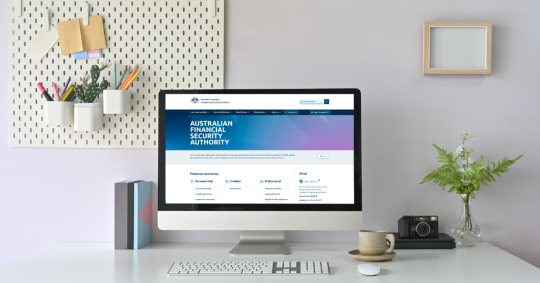

To set the scene, if you look at the chart (image 1 below) that I’ve just put up you’ll see the picture over the last 20 years. If you do a quick eyeball, you’ll see that the average over the past 20 years is about 28,000 insolvencies per year. The highwater mark was just 2 years after the GFC which was 37,000 and since then we’ve drifted down. Indeed, if you do the 10-year average it will drop down to 25,000 and there has been a downward trend. Clearly impacted by, most recently, the pandemic and the economic response to the pandemic but even before the pandemic there was a gentle and considered downward trend in insolvencies driven by as outlined in this chart a number of factors including and really importantly the Hayne Royal Commission to change creditor behaviour.

But as you can also see from this chart our landscape is changing, you see it day in day out. And what we’re seeing and what we’re likely to see over the next 12-18-24 months is us head back towards the 10-year average of around 25,000.

Over the last day and a half, we’ve heard the Minister and other speakers talk about the number of calls you’re hearing, and what you’re seeing coming through hotlines, people talking about their options and what they need to do.

And, of course, we’ve heard a lot about buy now pay later.

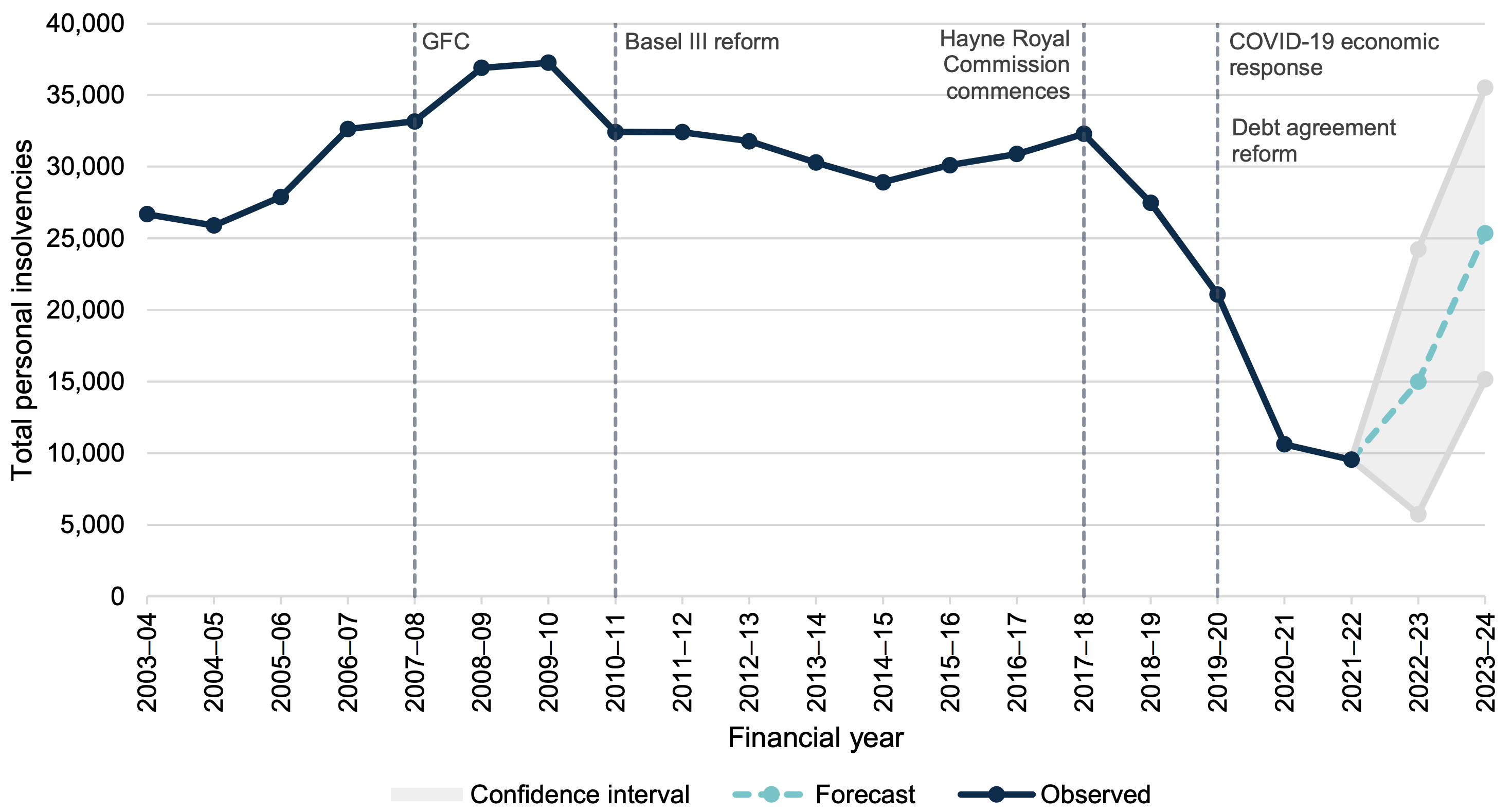

What is interesting when you unpack the $18 billion of liabilities or the 60,000 insolvencies is the breakdown in terms of where the debt sits and the size of that debt. The most interesting number on that slide (image 2 below) is that of the 60,000 insolvencies, 52% had debts less than $50,000. So think about that, someone with 2 credit cards and probably 5 to 8 buy now pay later arrangements. 52% of our system of debts less than $50,000.

We also know that the majority of our debtors and creditors who are inside the personal insolvency system, their experiences are highly dependent on the practices and behaviours of those who oversee it; the practitioners - be they Registered Trustees or Registered Debt Agreement Administrators. There’s around about 250-260 of these practitioners. Interestingly 12 amount to 75% of activity.

On creditor outcomes I touched on the $18 billion a bit earlier, the breakdown of that is, and it would be no surprise to any of you, the big 5 are the ATO and the Big 4 banks. They add up to 35% and more importantly it is the shadow they cast, the influence they have in the system in driving creditor behaviour. If you come back to that chart I just talked through earlier, the Hayne Royal Commission impacted banking behaviour which has impacted creditor behaviour more broadly. Hence the gentle slide down.

Image 2 - Debtor concentrations

So, what’s this all telling us?

If there is one thing just to remember in this discussion so far, it’s that personal insolvencies are at and remain at a relative low level. However, we are seeing a change and we are likely to see personal insolvencies head back towards the mean over the next 18 months.

Chapter 4 - The bell curve and regulatory stewardship

So our role in managing the personal insolvency system is to, on one hand, get the balance right in terms of protecting the vulnerable.

On the other hand, act decisively against those who are causing deliberate misuse.

And in the middle, we ensure compliance is the easiest option.

We call that regulatory stewardship and as a seat at the table we invite you to participate actively and continue to participate actively in that regulatory stewardship with us.

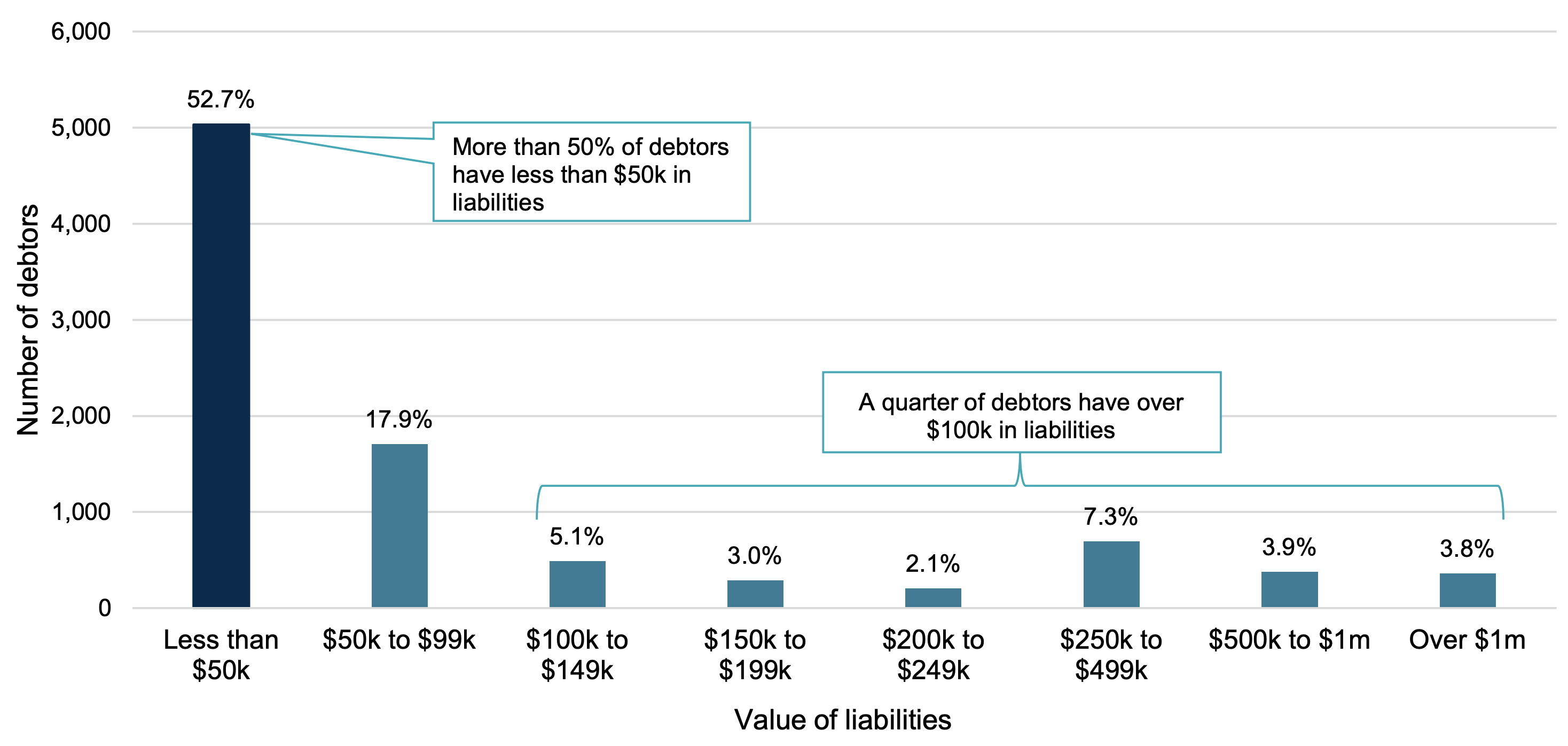

Inside our organisation we use a common conceptual bell curve diagram (image 3 below) that organisations use all the time, so I thought it would be worth sharing with you.

The bell curve talks about where the risks are and what we need to focus on. And there are 3 elements to the bell curve.

The left-hand side of the bell curve talks about those who face what we refer to as system vulnerability. The vulnerabilities you all know only too well.

The middle of the bell curve talks about how we focus on system efficiencies or where there is system inefficiency how do we make it simpler and easier.

And the right-hand side of the bell curve talks about system misuse. I am going to talk about each one of those in turn.

Chapter 4a - System vulnerability

Firstly, the left-hand side of the bell curve. I don’t need to re-emphasise with this audience, you understand how vulnerability is just such a wicked problem.

And as we know protecting those that are at risk of harm is often extremely complex.

A recent survey that we did highlighted that those people experiencing financial hardship were often victims of domestic violence, economic abuse, physical abuse and often also experiencing mental health issues.

As I said earlier, we must actively listen, learn and collaborate to strengthen our ecosystem and our work in the vulnerable part of the ecosystem.

After extensive consultation, we’ve launched our vulnerability framework which addresses noncompliance and exploitation by unscrupulous actors in the system.

We’re working with behavioural economists on touch points that nudge people to make decisions that support their long-term financial wellbeing.

We’re using regulatory sandboxes to pilot new approaches to ensure that we don’t create unintended consequences if we are addressing something in the vulnerable part of the system.

But our work doesn’t stop here.

We’re continuing to work across the sector - with you - and leverage the data to help us to reach and connect with those most at risk.

Chapter 4b - System efficiency

The second part of the bell curve - systems efficiency.

Most people when they are considering insolvency want simple information that helps them understand the options available to them.

They want to know what will happen if they decide to enter a formal agreement.

They need to understand the consequences of those choices.

Our role is to deliver smart, simple, secure and accessible services.

We want clients to be informed. To make compliance the easiest option.

To support efficiencies, we are investing heavily in technology.

We’ve just kicked off an extensive new service modernisation program which will take a couple of years to deliver. This significant program is across all our services to reduce duplication, red tape and provide real-time data.

The end goal is to streamline and make it simpler for all people to find the right answers. It’s about helping and supporting clients to make informed decisions - simply, securely and efficiently.

Chapter 4c – System misuse

The third part of the bell curve is where I want to just expand the conversation around a seat at the table. Systems misuse.

Our collective challenge is to effectively disrupt systems misuse.

Tip offs are a very effective way of doing this.

Your intel is extremely helpful to us.

Let me give you 2 tangible examples of where a tip off has led to an outcome. A recent judgement to fine a Registered Debt Agreement Administrator A&M Group trading as Debt Negotiators is a direct result of a tip off through our system which we shared with our co-regulator ASIC. Through that process the Federal Court ordered A&M Group to pay $650,000 for engaging in misleading and deceptive conduct relating to financial services, and undue harassment and coercion.

This was led by ASIC, through our tip off which came from some of you.

Another example of a tip off – recently as the Inspector-General I just cancelled the debt agreement registration of Sam Pos Pty Ltd trading as Debtcutter.

We identified through tipoffs that Debtcutter was no longer fit to be registered as a debt agreement administrator and we deregistered them.

We will act on intelligence and tip offs. We will act and we will enforce the law.

One that is certainly emerging, and I’ve heard it from a couple of you as well as others, is the issue around untrustworthy advisors, particularly those advisors involved in pre-insolvency. So, this is before people have decided to take the insolvency off-ramp. These pre-insolvency advisors are not CPAs or bookkeepers or licenced advisors. They are unlicensed and they are involved in pre-insolvency advice.

We are looking to work with our co-regulators DSS, ACCC, AFCA, ASIC – just to mention a few about how we can frame and tackle this problem of untrustworthy advisors who are unscrupulous with people who are considering the options around personal insolvency. We’ll have more to say on that in due course.

Chapter 5 - Outside our remit (beyond the bell curve)

Beyond the bell curve, beyond our remit if you like, beyond the Bankruptcy Act that we oversee and manage through our regulation, we’re also working hand-in-glove with our policy agency the Attorney General’s Department. Ensuring we continue to collaborate, listen and learn from stakeholders such as you.

A great example of that was recently under the leadership of the Attorney General the Hon. Mark Dreyfus who held an Attorney-General’s Personal Insolvency Roundtable in our office in Sydney in March.

It brought together representatives from 24 different parts of the ecosystem in credit, industry, finance, accounting, legal and social sectors.

The FCA was there, Consumer Action Law Centre (CALC) was there, CARE Financial Counselling was there and Financial Rights Legal Centre (FRLC), was there.

We discussed with the Attorney-General Mark Dreyfus a number of possibilities, some around increasing the bankruptcy threshold, response periods to the lengths for bankruptcy notices, early release options and how we can mitigate harms caused by those unlicenced or untrustworthy advisors.

We are now working back with our colleagues in the Attorney-General’s Department and indeed the Minister to progress those outcomes. It is us working together at the seat at the table.

Chapter 6 - Conclusion

So, in conclusion I’d just like to redouble our efforts to reinvite you to have a seat at the personal insolvency table. To work with us on system vulnerability, system efficiency and systems misuse.

We want you to have the latest and best information at your fingertips and we want to help.

Our next information session is in June, and we’ll cover how to complete the bankruptcy form and using our website.

To find out more check out the website.

And I am also pleased to announce that we are planning our first inaugural summit in October which will further explore the bell curve and beyond the bell curve.

We want to see you have a seat at the personal insolvency table.

As we said we are here to learn, here to listen and we’re here to collaborate so that we can work together to make the system stronger.

Thank you.