On this page

Speech by AFSA Chief Executive Tim Beresford at the 2023 Association of Independent Insolvency Practitioners (AIIP) conference, Friday 14 July.

Acknowledgement of country

Thank you for the opportunity to speak at your Association of Independent Insolvency Practitioners’ Conference.

First, I’d like to start with the acknowledgement to country. I’d like to acknowledge the traditional owners of the land on which we are all on today, the Ngunnawal and Ngambri people, to pay my respects to their elders, both parts of the present and emerging and recognise their continuing connection to their lands and their waters and their communities. And recognise their 65,000 years of stewardship of this land. I'd also like to recognise all the Indigenous and Torres Strait Islanders peoples in the room today, and the lands in which they come from.

Introduction

Good afternoon. I’m delighted to be here today at your conference.

My name is Tim Beresford. I’m the Chief Executive at the Australian Financial Security Authority.

I’ve been in the role since last May and I’ve had the pleasure to meet many of you to speak about AFSA and our direction.

Today I’d like to share a little bit about our organisation and our shift. Our evolution, to stay with the topic of the conference.

Before I do, I thought I’d just take a moment out to reflect on gender, as raised by previous presenters. As a small illustration of that evolution, the number of women registered trustees has gone from a single digit figure to now 12%, and the number of RDAA’s has gone from a single digit number to now 14%. Small, incremental evolution – and moving.

More broadly, we as an organisation are on our own transition to be a more proactive regulator with a more proactive posture. We’re doing this through our education, our compliance and enforcement.

This will enable us to respond to our regulatory ecosystem, changing economic environment and address emerging challenges.

Revolution or evolution?

The conference’s provocation, evolution or revolution, is a great topic and I’ve listened with great interest to a number of speakers today.

When I think of this topic, my mind turns to 2020 – the year of COVID-19. The pandemic illustrated that policy needed to immediately change. There was a revolution to deal with extraordinary circumstances.

The change, the revolution of ideas, of concepts and actions, it was overnight.

In our own space, the bankruptcy threshold was raised and the temporary debt protection period was increased. It is and was a lived experience for all of us.

It shows that revolution is indeed possible.

For AFSA, our regulatory posture is shifting. Not revolution, evolution. We are evolving and transitioning. I’ll explain why.

AFSA’s shift in regulatory posture

As many of you know, our role is to regulate in the personal insolvency sector.

As regulatory stewards, we must anticipate and respond to change.

Shifting our regulatory posture so that it addresses the economic headwinds, the changes in creditor behaviour and the changes in social license.

A strong posture enables us to act decisively, act and enforce the law.

We will continue to evolve.

Fundamentally, our remit is about supporting a strong credit system for Australia.

We’re here to ensure confidence in Australia’s personal insolvency system, confidence in the personal property securities systems and confidence in the management of criminal assets.

Within personal insolvency, we oversee and regulate more than $18 billion of liabilities in the Australian credit system.

Our active regulation is vital to the strengthening and protection of that ecosystem.

As a visible, modern and contemporary regulator, we are sharpening our regulatory posture to maximise our impact and our reach.

We are unapologetic to protect the vulnerable and disrupt misuse.

This shift involves us being more proactive, taking a whole-of-system approach to regulation.

We will and are using data and intelligence to prioritise where to focus our resources.

We are shifting to practical guidance.

We use a surveillance-based approaches to monitor our regulatory systems.

We take pre-emptive and strong actions in response to misuse. I’ll share some examples a little later.

We are acting swiftly and decisively.

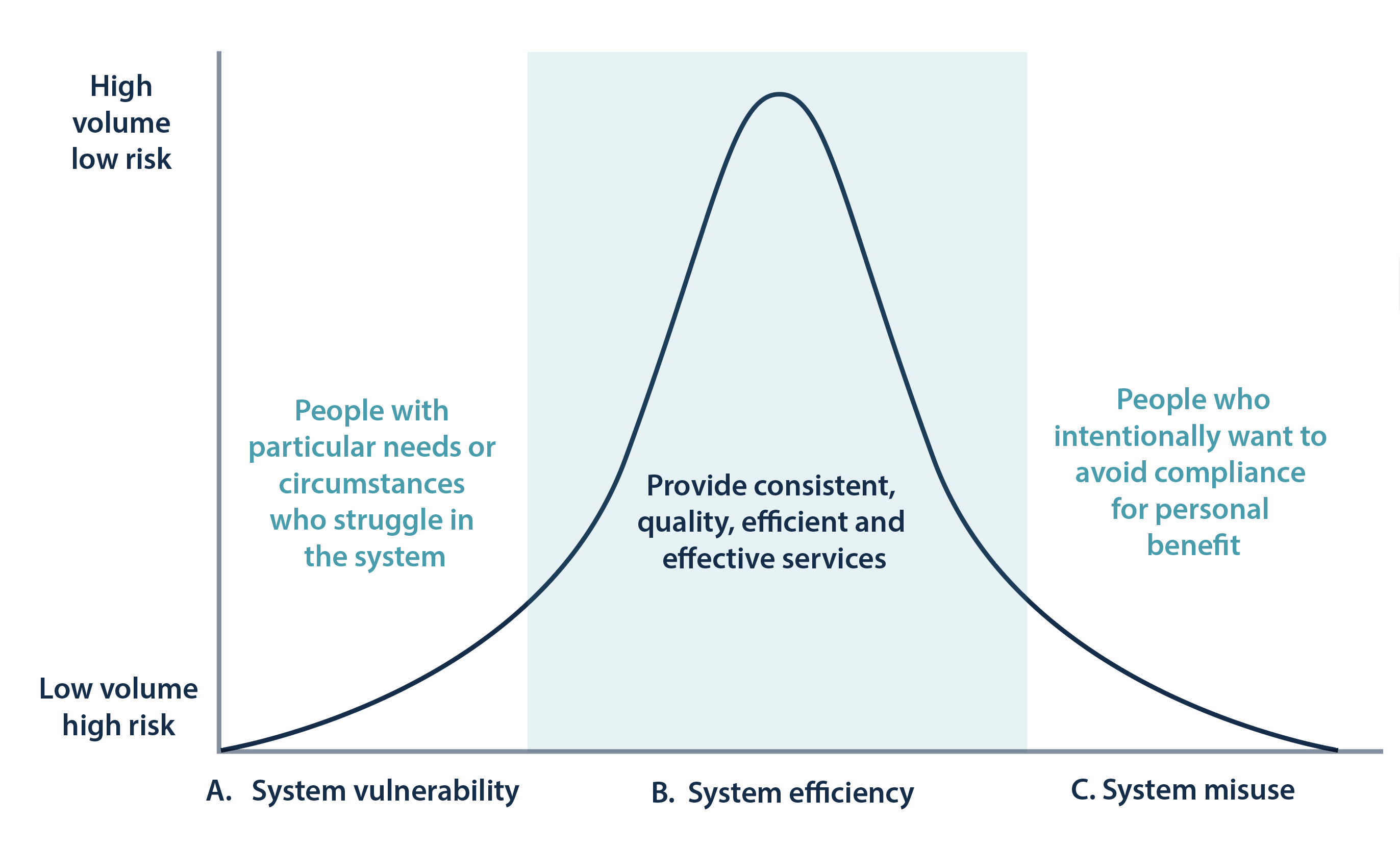

Inside our organisation we use a conceptual frame to describe some of that shift, our bell curve. The bell curve is all about assessing risks and where we need to focus.

The Bell Curve

In essence, there are three regulatory priorities, which are enduring. On the left, systems vulnerability is about working with many vulnerable people who genuinely at risk. In the middle of the bell curve, it’s about how we make compliance as easy as possible. On the right of the bell curve, it’s how do we act decisively against those that are causing deliberate misuse to the system.

Most people are in the middle of the bell curve – but there are people who are high-risk, low volume but nonetheless either suffering from systems vulnerability or systems misuse.

Let me share a practical example of what we’re doing in our organisation, in the middle of the bell curve. How we make compliance easy.

We are undertaking a multi-year journey around service modernisation, reducing from 8 operating systems to one operating system. This will drive productivity and regulatory effectiveness for both you, your clients and ourselves.

Workflows will be digitally integrated into a single service system. We’ll have a single view of clients and practitioners. We will reduce manual processing and minimise privacy concerns and security risks.

With this in place, we will be able to focus even more of our resources on the left and the right of the bell curve. On vulnerability and disrupting, enforcing and minimising harm.

This is part of our evolution.

The current state of personal insolvency

Let’s talk a little more in-depth about the personal insolvency system. This system has around $18 billion in liabilities. We view it through a number of lenses – the debtor lens, the creditor lens and the practitioner community lens, Registered Trustees and Registered Debt Agreement Administrators.

To better understand this, we have recent released a report around the state of the insolvency system. We released that earlier in the year, and there will be a follow-up later this year.

The report had three things that I thought I’d share with you. Firstly, from a debtor lens. That $18 billion is around about 60,000 personal insolvencies. Of those 60,000 personal insolvencies, over 50% or 30,000 have liabilities less than $50,000.

Think about that for a moment – that’s a person with two credit cards, 5 ‘buy now pay later’ accounts and say 7 to 10 utility bills to pay.

For the creditor lens, of the $18 billion, the ATO and the Big 4 banks make up over 35%. If you add in all the banks, it gets slightly above 40%. The question that I ask is where’s the other 60%? More work is underway to understand that.

From the practitioner lens – as you know, there are about 260 registered practitioners, however just 12 are responsible for 75% of personal insolvency activity. Internally, we refer to them as our tier ones, and we have a higher expectation on those top tier.

From a macroeconomic perspective, we know personal insolvencies are at historically low levels. The average over the last 20 years is about 28,000 insolvencies per year.

The highwater mark was 2 years after the GFC – that number was 37,000, since then we’ve drifted down.

The 10-year average is 25,000. Over the last 3 years there has been a significant downward trend. For the last 2 years that number has sat at 10,000 insolvencies.

Clearly, it has been impacted by the pandemic and the economic response but also factors such as the Hayne Royal Commission to change creditor behaviour.

Our landscape continues to evolve. And that’s why our regulatory posture must be strong. We must stand tall.

Over the next 12-18 months, we’re likely to see numbers heading back towards the 10-year average. Our prediction for 2023-2024 is an increase to 14,000 personal insolvencies.

Taking decisive action

As Independent Personal Insolvency Practitioners, you are on the frontline of this change.

As the regulator, this change brings great responsibility.

A responsibility to protect, disrupt and enforce.

As I said at the start, we are shifting our regulatory posture.

Naturally education and compliance to prepare, pivot and evolve are critical. And in our evolution, so too is enforcement.

As Chief Executive, I have led many forums which have surfaced a common theme – we must disrupt untrustworthy advisors.

We must be unapologetic about reducing their harm to our system.

We must stop those who prey on the vulnerable and misuse the system.

But it’s more than words. It requires decisive action from all of us.

At last month’s Personal Insolvency Stakeholder Forum and indeed at the Attorney-General’s Personal Insolvency Roundtable back in March – disrupting untrustworthy advisors and unlicensed practitioners was a key topic for that agenda.

I’m pleased to share that we are in the process of establishing a co-regulator taskforce with ASIC, to disrupt untrustworthy advisors and unlicensed practitioners.

This harm won’t be tolerated. We will seek it out and we will prosecute it.

This week, we’ve taken strong regulatory action on registered debt agreement provider A&M Group Pty Ltd, trading as Debt Negotiators.

As I stated in my media release, there are four main conditions and my action clearly demonstrates our commitment to maintaining the confidence and integrity in the personal insolvency system

Debt Negotiators will:

- Engage an external consultant to audit the company’s culture, systems and controls and report those findings to me.

- They are under a two-year supervisory period to ensure debtors are treated appropriately and fairly.

- They will provide information on their website explaining how debt agreements work, the implications of default and how to make a complaint to us.

- Debt Negotiators will notify me of any changes in key personnel within 6 weeks.

All costs will be borne by Debt Negotiators. Any failure to adhere to the conditions will result in further regulatory action.

An anonymous tip off was the catalyst for action. The initial investigation completed by AFSA led to a referral to ASIC and ultimately to civil action in the Federal Court, resulting in a $650,000 fine.

In another example of a tip off – I cancelled the debt agreement administration registration of Sam Pos Pty Ltd trading as Debtcutter.

A tip off led us to identify that Debtcutter was no longer fit to be registered as a debt agreement administrator.

We deregistered them.

Last month, we applied to the Federal Court regarding the repayment of $1.1 million, which is alleged to have been misappropriated by the Debtcutter operators.

The message is clear. Tip offs work. We will act and we will enforce the law. Our regulatory posture has shifted. We are unapologetic about this transition.

Conclusion

As independent insolvency practitioners, you are integral to this ecosystem.

Change is coming. Personal insolvencies are increasing.

As I’ve said today, as a visible, modern and contemporary regulator, we are evolving to respond to our ecosystem.

We are shifting our regulatory posture.

We are proactive, pre-emptive and we will do this through our tools in education, compliance and enforcement.

And importantly, we are unapologetic in our approach to disrupt and minimise harm.

We will continue to evolve, strengthen and sharpen our regulatory posture.

We will not slow down. We will not stop.

Our evolution is fundamental and we are about supporting a strong credit system for Australia and confidence for all Australians.

Thank you.