On this page

Australian Restructuring Insolvency & Turnaround Association (ARITA) National Conference 2023

Wednesday 2 August, 12:15pm, Gold Coast

Introductory remarks by Australian Financial Security Authority (AFSA) CE Tim Beresford, followed by a panel discussion, What to do about personal insolvency.

Panel members: Narelle Ferrier RITF, Technical & Standards Director, ARITA (moderator); Mike Hayes RITF, Partner, Piper Alderman; Steven Golledge SC RITP, Barrister; Jason Porter RITF, Executive Director, SV Partners

Chapter 1 - Introduction

Good afternoon, everyone. Thank you.

I’d like to acknowledge and pay my respects to the Yugambeh people, their language and their region. I’d also like to acknowledge all the indigenous peoples, their cultures, their customs, and recognise their ongoing contribution to their lands, their waters and their communities and their custodianship of this land for over 65,000 years.

My name is Tim Beresford and I’ve been the Chief Executive for the Australian Financial Security Authority for around 14 months.

And building off the Attorney General’s speech, today I would like to share with you some of the thoughts we have around our evolving regulatory capacity to build and ensure we have a strong personal insolvency system.

Specifically, and to quote the Attorney, to make the personal insolvency system simpler, to improve the experience of those who rely on it – aimed at the debtors and the creditors. I’ll look to briefly outline what the shifts look like and how you can support those shifts, as we are all part of the personal insolvency ecosystem.

Chapter 2 - AFSA’s shift in regulatory posture

As many of you know in this room, we oversee and regulate more than $18 billion of liabilities in the Australian credit system.

Our active regulation is vital to strengthening and protecting the personal insolvency ecosystem.

And we are shifting our regulatory posture to identify and address the current economic headwinds. To address changes in creditor behaviour. As well as meet community expectations regarding our collective social license to operate.

As a visible, modern and contemporary regulator, AFSA is taking a firm stance.

We are sharpening our regulatory posture to maximise our impact and our reach.

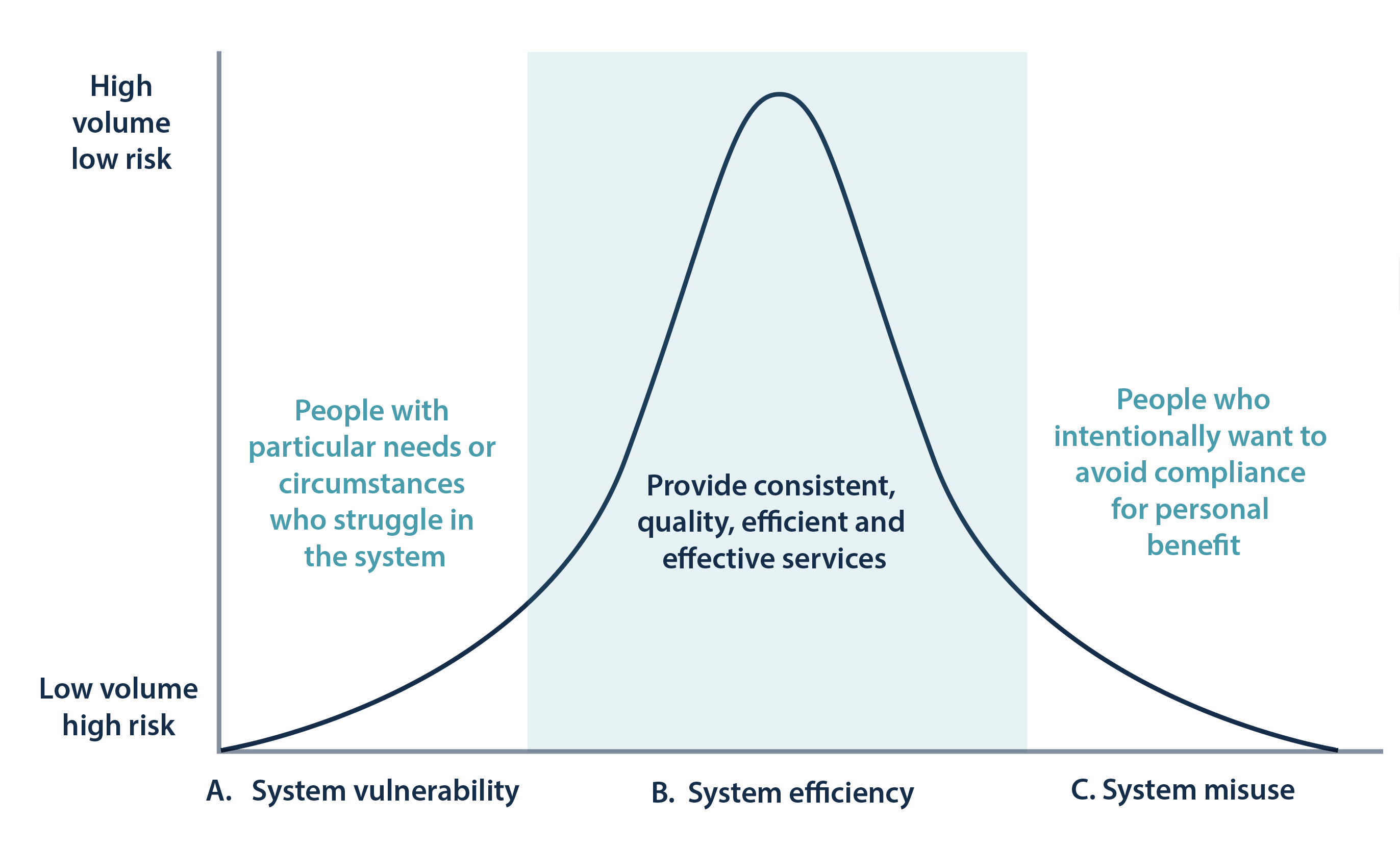

Let me share with you a simple framework we have internally which we refer to as our bell curve.

I will share with you a visualisation of the bell curve.

The Bell Curve

Think of a bell curve. In the middle of bell curve, is where the majority of people sit within the personal insolvency system.

That part of the bell curve is about making it as simple as possible to allow those people, the 95 per cent, the 90 per cent, the 99 per cent – the bulk of the system – to go through administration in the simplest and easiest way possible.

We refer to the middle part of the bell curve as systems efficiency. How are we playing our role to make the system more efficient and, more simple for users of the system.

We have kicked off a 3-year service modernisation program, to simplify our systems to make it easier for people to interact with our systems.

For bankrupt clients go from dealing with 8 systems down to 1 system. And yes, it will take 2-3 years to eventuate. But our job, is to make it easier for the vast bulk of people who use our system. And through that, yourself, and those interactions in that system.

Let me now pick the left-hand side of this bell curve. The left-hand side of this bell curve are for those that deal with serious vulnerability.

We would work with them, you would work with them, day in, day out. They have financial stresses. But beyond financial stresses, they are also suffering other forms of stress, or abuse. Domestic violence. Physical, mental abuse, sexual abuse, mental health, physical health issues.

We refer to the left-hand side of that bell curve, as those dealing with system vulnerability.

The third part of the bell curve – the right of the bell curve – are those that are deliberately and unlawfully misusing the system. We refer to that part as systems misuse.

There are three elements: systems efficiency, systems vulnerability and systems misuse.

Let me talk a little more about systems misuse. Or rather before I get there, I’m going to talk a little bit about how we simplify our focus.

As many of you in the room know, last year the number of insolvencies was round about 10,000. For many of you that have been round these tables for a long time, before COVID-19, insolvencies sat on average – on a 10-year average - on 25,000.

Last year it was 10,000. Of that, 50% - or just over 50% or just over 5,000 – involved liabilities of less than $50,000. A credit card, a personal loan and 5 or so buy now pay later. Less than $50,000.

91% of that 5,000 – just over 4,500 – are consumers. It’s consumer debt. Less than 10% of that was business debt. Inside that 5,000, 50% of those – 2,500 – had assets less than $10,000.

These bankrupts provide creditors no returns.

Chapter 3 - Personal Insolvency - learning from others

As we move forward, and strengthen our personal insolvency system, we need to learn by others.

Notably the Attorney General mentioned, New Zealand’s No Asset Procedure, or as it’s colloquially referred to in New Zealand, the NAP.

The NAP was established in 2007/2008. And it has been very successful in simplifying the administration over two business cycles – the Global Financial Crisis (GFC) and more recently, COVID-19.

In effect, consumer debtors are given a quicker, fresh start.

Their bankruptcy lasts for about 1 year and is only available once. Any future bankruptcies will be administered as normal. And in New Zealand, it’s 3 years, like us.

Taking the NAP’s lead could allow debtors and creditors to swiftly return to their focus of more productive economic outcomes.

And, it would enable us, the Official Trustee, to focus on the left-hand side of the bell curve and the right-hand side of the bell curve, where there is systems vulnerability and where there is systems misuse.

Chapter 4 - Taking decisive action

Let me talk a little bit about misuse.

Make no mistake – harm will not be tolerated. We will seek it out and we will prosecute it using surveillance, data and intelligence.

Last month, we took strong regulatory action on registered debt agreement provider A&M Group Pty Ltd, trading as Debt Negotiators.

As many of you in the room would recall in December last year – December 2022 – following an anonymous tip off and after an investigation from ourselves and a referral to ASIC, Debt Negotiators were fined $650,000 by the Federal Court of Australia.

The court found that they had engaged in deceptive conduct and undue harassment of debtors who had missed payments.

I, as the Inspector-General, have imposed additional conditions on Debt Negotiators.

For the next two years, Debt Negotiators will be watched closely.

And to give you a flavour of some of those conditions, they’ve been instructed to engage with an external consultant that will report to me on an audit of the company’s culture, its systems, its controls and report regularly to the Inspector General.

They need to notify me of any personnel changes – in or out within six weeks. They are just some of those conditions. They are on our website if you wish to see them all.

All costs are borne by Debt Negotiators.

Any failure by Debt Negotiators to these conditions will result in further regulatory action.

And for the room, what happened here was an anonymous tip off, which we actioned.

Tip offs are a vital source of intelligence for our enforcement activities.

We are all stewards of the system. I invite you – I encourage you – to report poor behaviour.

Another example of poor behaviour, which the Attorney General highlighted earlier and indeed ARITA have referred to in many submissions – is around untrustworthy advisors, particularly in the pre-insolvency space.

We are here in the Gold Coast. There are people here in the Gold Coast, who are doing that, right now, today. It was also outlined by Senator Deborah O’Neill’s report, in the PJC, about a real need to focus on untrustworthy advisors.

We’ve agreed and are now working together with ASIC – putting a joint taskforce together about how we address this harm. More will follow in this space.

As I said, we will act and, we will enforce the law.

Chapter 5 - Conclusion

In conclusion, as I’ve said today, we are about becoming a visible, modern and contemporary regulator and evolving in our ecosystem.

We are shifting our regulatory posture.

We are proactive, pre-emptive and we will do this through our tools in education, compliance and enforcement.

And as insolvency practitioners and professionals, you are integral to this ecosystem. Our shared ecosystem.

As stated earlier, personal insolvencies have fallen to historic low levels – around 10,000.

And, we expect them to increase. Our prediction over the course of this financial year, is that they will rise from around 10,000 to around 14,000.

And you are on the front line of that increase, of that change.

Notably, as many of you know there are around 260 registered practitioners, but just 12 deal with 75% of personal insolvency activity.

We have a high - a very high - expectation of those 12. And a high expectation of the remaining 250.

We will not accept those who harm vulnerable people. And you mustn’t either.

We need your help to stamp out the bad actors in the personal insolvency. Tip offs work.

Together, we can maintain a strong credit system for Australia, and confidence for all of us and all Australians.

Thank you and I will now hand over to Narelle.