On this page

-

Introduction

- A bankruptcy notice is a formal notice of demand requiring a debtor to pay a judgment debt. Pursuant to section 41 of the Bankruptcy Act 1966, the Official Receiver may issue a bankruptcy notice on the application of a creditor who has satisfied various requirements.

- Failure by a debtor to comply with a bankruptcy notice constitutes an “act of bankruptcy” pursuant to section 40 of the Bankruptcy Act.

- In a situation where a debtor has committed an act of bankruptcy in the preceding 6 months, a creditor may apply (referred to as a “creditor’s petition”) to the Federal Court or Federal Circuit and Family Court for an order that a debtor be made bankrupt (referred to as a “sequestration order”). The majority of creditors’ petitions presented to the Court are based on debtors’ failures to comply with bankruptcy notices.

-

Scope of this practice document

- This practice document has been prepared to provide detailed information about the legislative and practice requirements relating to bankruptcy notices for debtors and creditors. If you would like more general overview, you may wish to read the information on AFSA’s website.

-

Processing a bankruptcy notice application

-

The application

- An application for a bankruptcy notice can be made by the creditor or the creditor’s solicitor/duly authorised agent. Where a solicitor/agent is applying for the issue of a bankruptcy notice on behalf of a client, this should be indicated during the application process. The solicitor/agent needs to be satisfied that the requisite authority to apply for the bankruptcy notice to be issued has been obtained.

- An application for a bankruptcy notice must be submitted via AFSA’s Online Services (once registered as a user). A creditor who is not registered for AFSA’s Online Services will need to register on AFSA’s website so that applications can be submitted to the Official Receiver via the website.

- The appropriate application fee will have to be paid as part of the online application process. More information about the fee can be found below.

- To apply online for the issue of a bankruptcy notice, the creditor will need to have one of the following:

- a copy of the sealed or certified judgment(s) or order(s)

- a certificate of the judgment(s) or order(s) sealed by the Court or signed by an officer of the Court, or

- a copy of the entry of the judgment(s) or order(s) certified as a true copy of that entry and sealed by the Court or signed by an officer of the Court.

- An application for a bankruptcy notice that does not comply with the requirements outlined above may be returned for resubmission.

-

The application fee

- A creditor applying for the issue of a bankruptcy notice must pay the application fee at the time of lodgment unless an alternative payment arrangement has been agreed with AFSA. The fee may be paid by credit card or bank payment (electronic funds transfer - EFT). For more information see Creditor bankruptcy notices payment information.

- The application fee attaches to the application for issue of a bankruptcy notice and not the issue of a notice. This means that the fee is payable when the application is made, even if the notice is not ultimately issued by the Official Receiver.

- A creditor who frequently applies for the issue of bankruptcy notices may wish to consider becoming an on-account customer with AFSA. Details about this can be found on AFSA’s website.

- The fee for the application for issue of a bankruptcy notice is GST exempt. A GST invoice is therefore not issued to the applicant.

- The application fee cannot be waived or refunded where a creditor later discovers that there was an error or deficiency in the application and/or attachments that were submitted to the Official Receiver.

- The application fee is not refundable if a creditor subsequently changes their mind regarding proceeding with obtaining a bankruptcy notice after lodging an application with the Official Receiver.

-

Judgment/order overview

- A precondition to the issue of a bankruptcy notice is the existence of either:

- a final judgment or final order that is for an amount of at least $10,000, or

- 2 or more final judgments or final orders that, taken together, are for an amount of at least $10,000.

- The $10,000 minimum is provided for in section 10A of the Bankruptcy Regulations 2021.

- During the application process, one of the documents referred to in paragraph 2.4 will need to be attached or uploaded.

- Some jurisdictions provide for the “extraction” of judgments electronically rather than on paper. Whether a judgment that has been extracted electronically will be sufficient to support a bankruptcy notice will depend on State or Territory legislation in respect of electronic judgments.

-

The $10,000 minimum

- The amount outstanding under the judgment(s) or order(s) at the time that the bankruptcy notice is applied for must be at least $10,000.

-

Example 1

A judgment for $9900 plus $100 pre-judgment interest plus $100 costs is a judgment for $10,100 and will meet this requirement.

-

Example 2

A judgment for $9900 will not meet the requirement if, at the time of applying for issue of the bankruptcy notice, the amount owing pursuant to that judgment may be $9900 plus $200 post-judgment interest.

-

- On occasion, a judgment or order may be issued by a Court that refers to a number of other judgments/orders and directs their payment (for example, where a number of orders for costs are made during an action and a final judgment is made that refers to the previous costs orders and directs their payment). An application based on this judgment should have the final judgment and the other orders referred to in that judgment uploaded.

-

Post-judgment interest

- Interest on a judgment or order amount can only be claimed if allowed by the terms of the judgment or order or by the rules of the Court in which the judgment or order was given. An amount of interest must be specified (hereafter referred to as “post-judgment interest”).

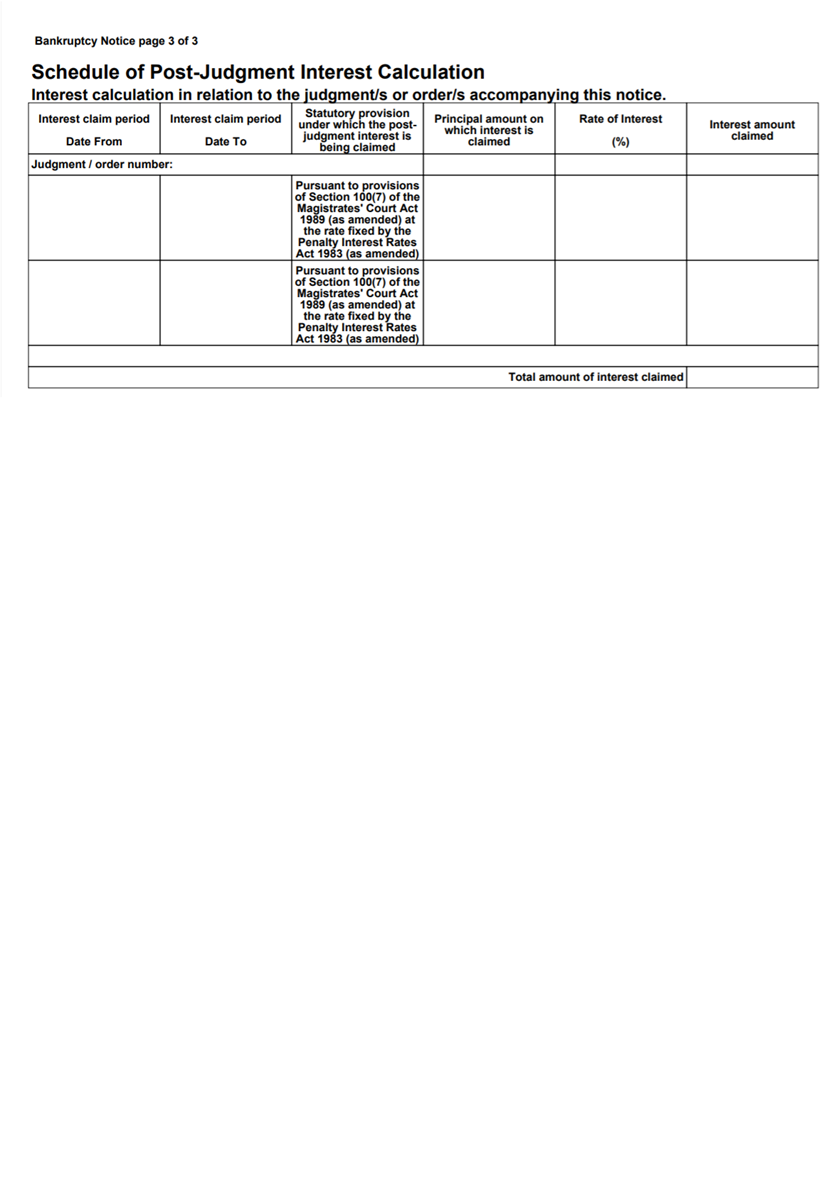

- The schedule of the post-judgment interest calculation must be completed if interest is claimed for any part of the period after the date of the judgment or order. The interest claim period should be completed, as well as the statutory provision under which the post-judgment interest is claimed, the principal on which the interest is claimed, the rate of interest and the total interest claimed.

- If more than one judgment or order is relied upon, a separate interest commencement date is likely to apply for each judgment or order. The Official Receiver may review the interest calculation and may query a calculation that could not on any reasonable or objective assessment be correct (that is, where there is an obvious or immediately apparent defect); however, the Official Receiver will not verify the calculation of the interest claimed and correct arithmetic calculation is a matter entirely for the creditor. Applicants will have the assistance of an online calculation tool for this purpose.

- A creditor may elect not to claim post-judgment interest rather than calculate the amount.

-

Judgment/order more than 6 years old

- Paragraph 41(3)(c) of the Bankruptcy Act prohibits the issue of a bankruptcy notice based on a judgment or order more than 6 years old.

-

Costs included in judgment

- A Court may order that the payment of costs be “taxed”. A bare order for costs without specifying an amount is an order for taxed costs. The costs order cannot be enforced (nor a bankruptcy notice issued based upon it) until taxation by the Court or assessment by an assessor has occurred and a sealed bill of costs or a certificate is issued.

- In most jurisdictions, the sealed bill of costs or certificate issued following taxation or assessment of the bill is likely to constitute a “final order” without the requirement to provide a copy of the original judgment or order directing payment of costs. However, that will depend on the terms of legislation or other statutory instrument (usually the relevant Rules of Court) that governs taxation or assessment of costs in that jurisdiction.

- If an application for a bankruptcy notice is based wholly or in part on an order for taxed costs, a copy of the original judgment (or copy certified by the Court) should accompany an original of the sealed bill or certificate. However, where the creditor chooses not to present the original judgment or order, the creditor should provide in writing the legislative authority that directs that the bill or certificate be treated as a “final order”. This can be uploaded through AFSA’s Online Services.

- If a judgment or order includes a direction for the payment of costs to be taxed, the creditor may elect not to have the costs taxed and, instead, apply for the issue of a bankruptcy notice based solely on the amount awarded in the judgment, provided the amount exceeds the $10,000 statutory minimum.

-

Foreign judgments and debts in foreign currency

- A bankruptcy notice can be issued based on a judgment or order obtained from a Court outside Australia. As with other judgments supporting the issue of bankruptcy notices, the creditor must be in a position to issue immediate execution. This will usually require registration of the foreign judgment in an Australian Court.

- The Official Receiver will require evidence of registration of the judgment or an explanation why registration is not required for the judgment to be enforced.

-

Where a judgment provides for a debt in foreign currency, section 12 of the Bankruptcy Regulations provides for converting the amount to Australian currency:

… using the rate of exchange for the foreign currency published by the Reserve Bank of Australia in relation to the day that is 2 business days before the day on which the application for the notice is made.

-

Stayed and suspended judgments/orders

- A Court may order that a judgment or order is stayed or suspended. Such a judgment or order cannot support the issue of a bankruptcy notice as it is a requirement that the creditor be in a position to issue immediate execution on the judgment or order – see paragraph 41(3)(b) of the Bankruptcy Act.

-

Example 3

A judgment debtor appeals a judgment and applies for and obtains a stay of the judgment pending appeal. In this situation, the creditor cannot rely on the judgment for the issue of bankruptcy notice because of the stay. (Note that an appeal (without a stay order) does not automatically suspend the effect of a judgment for enforcement purposes – it is necessary for a Court to order a stay of execution, otherwise execution of the judgment can continue even if there is an appeal.)

-

- A judgment or order may also be stayed or suspended pending some prerequisite being satisfied – this prerequisite may or may not be contained in the judgment or order itself. A judgment subject to a precondition being satisfied to effect enforcement cannot support the issue of a bankruptcy notice unless that precondition has been satisfied.

-

Example 4

The terms of a judgment may explicitly state that it is to be suspended for a set period.

-

Example 5

Section 21B of the Crimes Act 1914 provides that a certificate specifying certain details of a reparation order made in Commonwealth criminal proceedings must be filed in a civil Court before it becomes a “final judgment.

-

Example 6

Where a judgment debt is assigned by the judgement creditor to another party (the assignee), the assignee may require leave of the Court before a writ of execution can be issued on the judgment or the judgment can otherwise be enforced – whether leave is required will depend on the Court or civil procedure rules of the Court/jurisdiction in question. If leave is required, the judgment or order is considered to be stayed until the Court’s leave is obtained.

-

-

Assigned debts

- Where a judgment creditor (the assignor) assigns a judgment debt to another creditor (the assignee), the Official Receiver will require proof of the assignment to be lodged with the application for the bankruptcy notice.

- Paragraph 40(3)(d) of the Bankruptcy Act provides that a person, who is for the time being entitled to enforce a final judgment or final order for the payment of money, shall be deemed to be a creditor who has obtained a final judgment or final order (and hence is entitled to seek the issue of a bankruptcy notice if the other relevant criteria are satisfied).

-

Tribunal orders

- A bankruptcy notice may be issued based on an order of a tribunal. Where the legislation establishing the relevant tribunal allows for the registration of orders/decisions with a Court, the onus is on the applicant creditor to do so before applying for the bankruptcy notice.

-

Execution and issue of the bankruptcy notice

- Upon issue of the bankruptcy notice, it is endorsed by the Official Receiver and a bankruptcy notice registration number and the date of issue are inserted. The endorsed notice will be emailed to the applicant.

-

Time period for compliance

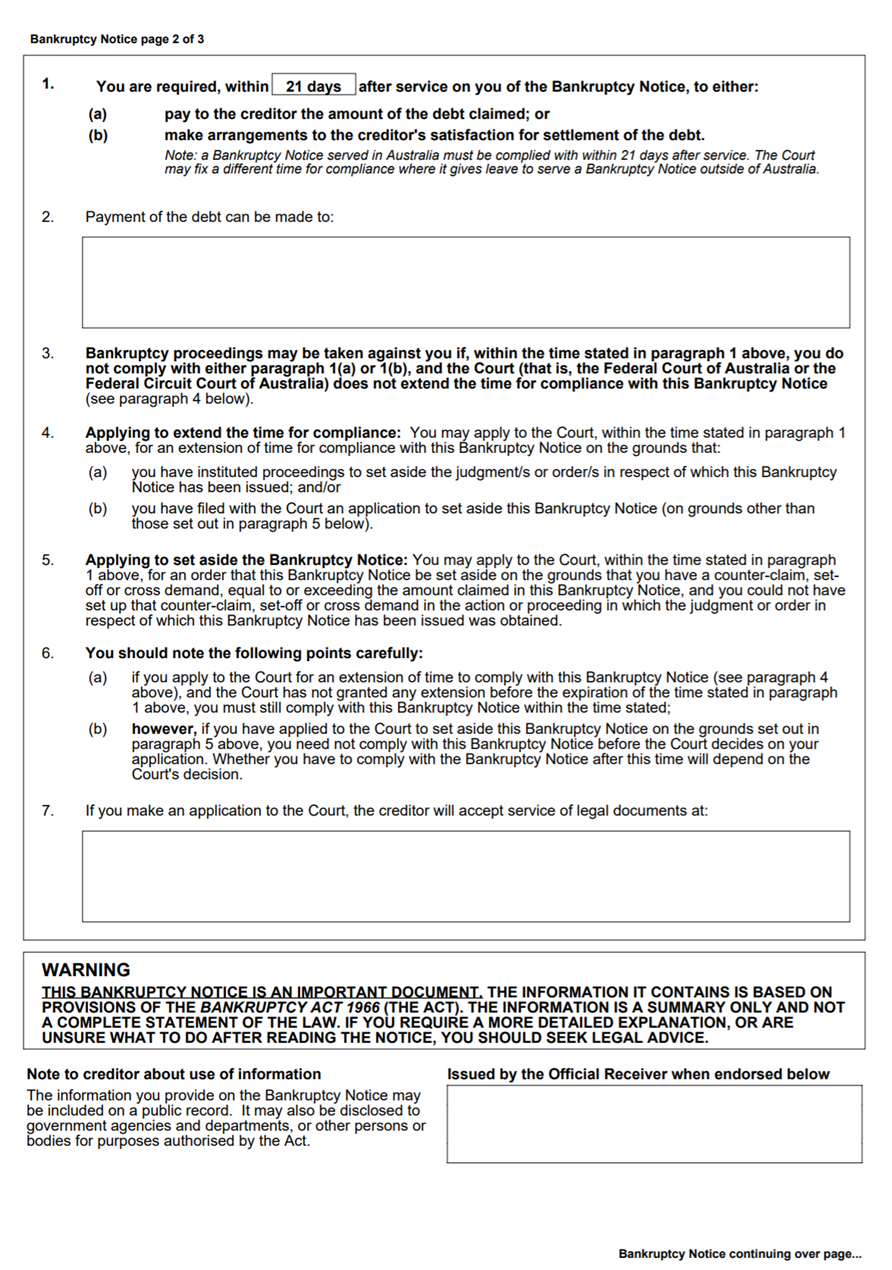

- The debtor is to be afforded 21 days from the date of service for compliance with the bankruptcy notice.[1]

-

-

The Official Receiver’s role

- The role of the Official Receiver[2] in issuing bankruptcy notices includes:

- providing information on the application procedure and the form for use

- when an application for issue of a bankruptcy notice is received from a creditor, assessing whether to issue it or return the application to the creditor with suggested amendments

- amending a previously-issued bankruptcy notice upon application by the creditor, if the requested amendment(s) is supported by a Court order

- extending the period for service of a bankruptcy notice upon application by the creditor.

- The Official Receiver will not issue a bankruptcy notice if there is an obvious or immediately apparent defect in the information provided.

-

Defects the Official Receiver will identify

- The Official Receiver will assess the bankruptcy notice application to ensure that there are no obvious or immediately apparent defects that would render it invalid.

-

The Official Receiver will review a bankruptcy notice to ensure that:

- where an application is lodged online, all of the information required for assessment has been included

- it is based on one or more final judgment(s) or order(s), the total of which equals or exceeds the statutory minimum amount

- the judgment(s) or order(s) relied upon are not more than 6 years old

- the debtor and creditor have been adequately and accurately described (with reference to the judgment(s) or order(s)) to avoid misleading the debtor

- the requirements for the debtor to comply with the notice are clear

- if interest is included, the basis on which interest has been charged and calculated is clear.

-

Defects the Official Receiver will not identify

- The issue of a bankruptcy notice does not represent a certification of all aspects of the bankruptcy notice or a guarantee that it will support the issue of a creditor’s petition.

- The Official Receiver will not identify defects that are not obvious or immediately apparent on the face of the bankruptcy notice application.

-

The Official Receiver will not:

- go behind a judgment or order to ensure there is no counter-claim, set-off or cross-demand

- certify that a judgment or order is “final” (that is, there is nothing which would prevent the creditor seeking to execute it, such as statutory barriers or a stay of execution)

- recalculate any interest claimed to ensure that the amount is correct

- certify that the section under which interest is claimed is the correct section in the circumstances of the judgment or order

- conduct a search of the National Personal Insolvency Index (“NPII”) to ascertain whether the bankrupt named in the bankruptcy notice application is already bankrupt or subject to either a debt agreement or personal insolvency agreement.

(A creditor may wish to consider conducting a search of the NPII. Information about this process is available on AFSA’s website.)

- In situations where the Official Receiver identifies an apparent defect in the application and contacts the creditor and the creditor then confirms that the details therein are in fact correct, notes of communications with the creditor will be retained by the Official Receiver.

-

Creditor’s street address

- A creditor only providing a PO Box address on a bankruptcy notice will invalidate the notice. This was addressed most recently in Sarina v O’Shannassy (No 2) [2021] FCCA 338. The Official Receiver will therefore refuse to issue a notice where the creditor has not provided a street address.

- The role of the Official Receiver[2] in issuing bankruptcy notices includes:

-

Service of a bankruptcy notice on the debtor

- The bankruptcy notice must be served on the debtor within 6 months of the issue of the notice.

- Given the significant consequences of non-compliance with a bankruptcy notice, including potential bankruptcy proceedings in the Court, a creditor should consider personal delivery to the debtor. Court rules require that an affidavit of service of the bankruptcy notice be filed with an application for a creditor’s petition.

- While section 102 of the Bankruptcy Regulations provides some information regarding service of a bankruptcy notice, it is recommended that a creditor seek independent legal advice regarding the use of these alternative service methods, particularly if subsequent bankruptcy proceedings are anticipated.

-

Extension of time within which to serve a bankruptcy notice

- Where the creditor is unable to serve the notice on the debtor within 6 months from the date of issue of the notice, the creditor can apply for an extension. The application to the Official Receiver may be made either before or after the initial 6 months have expired.

- A fee is payable when applying for an extension of time in which to serve a bankruptcy notice on a debtor.

- The Official Receiver’s power to extend the time for service of the notice on the debtor is discretionary.

- An application for an extension of time for service of a bankruptcy notice must be accompanied by a statement by the creditor or the creditor’s agent explaining why an extension is required. The statement should outline what attempts have been made to serve the bankruptcy notice within the original 6-month period.

-

An application for extension of time within which to serve should include details of:

- the number of attempts by a process server or other agent to serve the notice

- the number of locations at which service has been attempted

- the attempts made to locate the debtor other than at known addresses

- the likelihood that the notice will be successfully served if an extension is granted.

- The Official Receiver is entitled to extend the time for service of the bankruptcy notice for any period considered appropriate. However, periods of extension will generally only be granted in blocks of up to 6 months from the original date of expiry of the bankruptcy notice.

- An application to extend the time within which to serve the bankruptcy notice that is made more than 6 months after the bankruptcy notice was originally issued will only be granted in exceptional circumstances.

-

An application for extension of time for the service of a bankruptcy notice made more than 6 months after it was originally issued must, in addition to the information outlined in paragraph 5.4 and the text box following that paragraph, include:

- a clear explanation of why the application was not made earlier

- reasons why an extension is to be preferred over the issue of a fresh notice.

- More than one extension can be granted by the Official Receiver. However, a second (and any subsequent) extension will only be granted in exceptional circumstances.

-

An application for a second or subsequent extension of time within which to serve a bankruptcy notice should, in addition to the information outlined in paragraph 5.4 and the text box following that paragraph, include:

- what further attempts to locate and serve the debtor have been made in the period since the previous extension was granted

- the likelihood of successfully serving the notice if another extension is granted, taking into account the failure to serve in the period since the previous extension was granted (that is, why service is more likely now than in the previous extended period).

- An extension is given by way of an extension notice issued by the Official Receiver.

-

Amendment of an issued notice

- The Official Receiver will generally only amend a bankruptcy notice when the amendment is ordered by the Court. An exception may be made where the amendment is minor, such as a change to the spelling of the debtor’s name where an updated judgment is provided.

- Where an amendment is ordered by a Court, the creditor is required to return the endorsed bankruptcy notice that was issued by the Official Receiver, noting the changes required by neatly striking through the relevant original text and inserting the replacement text by hand. This will need to be submitted with a copy of the Court order.

- Should a creditor require an amendment to a bankruptcy notice that has been issued but not served without there being a Court order requiring an amendment, and where those amendments are not minor and straightforward in the opinion of the Official Receiver, an application for a new notice will be necessary and another application fee will be payable.

- If the application to amend an issued notice is in order, the Official Receiver will endorse and date the first page of the notice.

-

The sequestration order (bankruptcy) process

- Where a creditor wishes to petition the Court to have a debtor made bankrupt, the following conditions must be satisfied in accordance with sections 43 and 44 of the Bankruptcy Act:

- the debtor must have an Australian connection

- the debtor must owe a debt of $10,000, or 2 or more debts that amount to $10,000 or more

- that the debt(s) is a liquidated sum

- that the debt(s) is payable immediately or at a certain future time

- that the debtor has committed an “act of bankruptcy” within the 6 months before presentation of the petition.

- Acts of bankruptcy are listed in section 40 of the Bankruptcy Act and one such act is where a debtor who has been served with a bankruptcy notice does not comply.

- More information about filing a creditor’s petition is contained in Bankruptcy by sequestration order and the Federal Court’s Bankruptcy Guide.

-

Costs of the petitioning creditor

- A creditor who has successfully petitioned the Court to have a sequestration order made may be entitled to have their costs paid (if sufficient money is realised by the trustee in the bankrupt estate) ahead of certain other disbursements from the estate. However, for this to occur, the sequestration order itself must either fix the costs or provide for the petitioning creditor’s taxed costs to be paid from the estate in accordance with the priorities in the Bankruptcy Act.

-

The Federal Court and Federal Circuit and Family Court have similar forms for use in bankruptcy proceedings and the Form 7 – Sequestration order template provides for the following:

The applicant creditor’s costs be taxed and paid from the estate of the respondent debtor in accordance with the Bankruptcy Act 1966.

- It is therefore recommended that a petitioning creditor ensure that such a clause is inserted in the order or, to avoid the need to have costs taxed, the Court specifies a dollar amount as payable to the petitioning creditor.

- In the circumstance where a petitioning creditor seeks to have their costs paid in priority to certain other disbursements and the order does not provide for this, the creditor will need to go back to the Court and obtain a further order to that effect.

- Where a creditor wishes to petition the Court to have a debtor made bankrupt, the following conditions must be satisfied in accordance with sections 43 and 44 of the Bankruptcy Act:

-

Inspection of a bankruptcy notice

- A bankruptcy notice is not available for inspection unless and until a creditor’s petition based upon its non-compliance is issued.

- The notice can, however, be inspected prior to the issue of a creditor’s petition by the parties to the notice and their agents. Adequate identification is required.

- More information about requesting access to a bankruptcy notice is available in Inspecting documents filed with the Official Receiver.

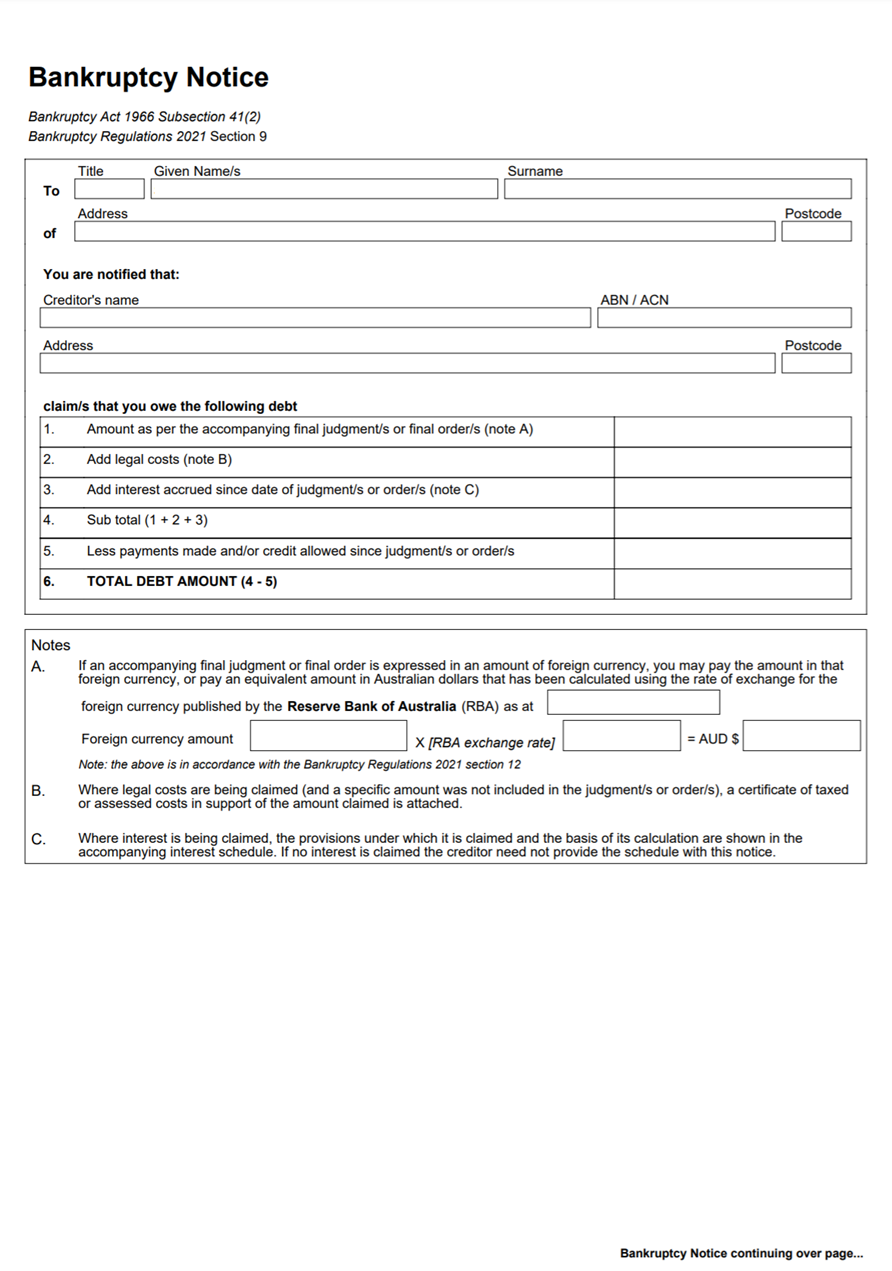

Annexure A – Form 1 – Bankruptcy Notice

Footnotes

[1] Note that, for the period 25 March 2020 to 31 December 2020, the compliance period was 6 months, pursuant to temporary coronavirus changes

[2] A reference to the Official Receiver in this paper also refers to a delegate of the Official Receiver