On this page

-

Introduction

-

What is a debt agreement?

- Part IX of the Bankruptcy Act 1966 provides for a debtor putting a proposal to their creditors regarding repayment of provable debts, with creditors then voting whether to accept or reject the proposal. The proposal will specify the amount creditors will receive and the period over which the debtor will pay the total.

- The creditor voting process is conducted by the Official Receiver.[1]

- All creditors who are owed provable debts are then bound by the voting outcome.

- A debtor must appoint a registered debt agreement administrator or registered trustee to administer the agreement.[2] The registration requirements for administrators and trustees can be found in Processes for registration of debt agreement administrators.

- The administrator manages the debt agreement, which includes monitoring compliance with the terms of the agreement by the debtor and paying dividends (distributions of money) to creditors.

-

Scope of this practice document

- This practice document has been prepared to provide detailed information about the legislative and practice requirements of debt agreements for debtors, creditors and administrators. If you would like more general overview, you may wish to read the information on AFSA’s website.

-

Eligibility

- There are certain eligibility criteria applying to debt agreements, which are outlined in this practice document. A debtor who is ineligible to propose a debt agreement may instead be able to become bankrupt or enter into a personal insolvency agreement, subject to certain other requirements. In a bankruptcy or personal insolvency agreement, the debtor’s affairs will be investigated by a trustee.

-

Lodgment fee

- When a debt agreement proposal is lodged with the Official Receiver, the debt agreement proposal lodgment fee (presently $200) is payable.

-

Online lodgment of forms and other documents with the Official Receiver

- To lodge a debt agreement proposal, certain forms must be completed and submitted to the Official Receiver, who will ensure that the paperwork is complete and in order to be put to creditors for their vote.

- Debt agreement forms must be submitted electronically via debt agreements online or AFSA’s Business to Government channel.

-

-

Types of debts and their treatment

-

Terminology

- A debtor is any person who owes money.

- An insolvent debtor is a person who is unable to pay their debts as and when they fall due.

- A creditor is a person to whom or entity to which money is owed. The money may be owed for various reasons, such as the repayment of a loan, a Court order requiring the debtor to pay damages for a car accident, outstanding school fees etc.

-

Legislative treatment of debts in a debt agreement

- How certain debts are treated in a debt agreement is outlined in various provisions of the Bankruptcy Act. This means that debtors, creditors, administrators and the Official Receiver do not have the power or discretion to determine which debts are provable in a debt agreement and which are not, nor which are extinguished and which are not.

-

Secured / unsecured

- A secured debt is tied to specific property. Examples include:

- a mortgage (where the house is security)

- a car loan (where the car is security)

- hire purchase or rent to buy (where items such as furniture or electronics are the security).

- For a debt agreement, a secured creditor means:

- in the case of a debt secured by a Personal Property Securities Act 2009 (“PPS Act”) security interest – the PPS Act secured party in relation to the interest, if the interest:

- i. arose as security for the debt

- ii. is perfected (within the meaning of the PPS Act), or

- in the case of any other debt – a person holding a mortgage, charge or lien on property of the debtor as a security for a debt due.

- in the case of a debt secured by a Personal Property Securities Act 2009 (“PPS Act”) security interest – the PPS Act secured party in relation to the interest, if the interest:

- The secured creditor will have certain rights regarding taking possession of the property if the debt is not paid in accordance with the terms of the loan or agreement.

- Section 185XA of the Bankruptcy Act provides for the rights of a secured creditor not being affected by the lodgment of a debt agreement proposal or the making of a debt agreement.

- An unsecured debt is a debt that is not tied to any property or right. This means that the creditor is not able to take possession of any property if the debtor does not make repayments.

- Whether a debt is secured or unsecured depends on the specific contract or agreement between the debtor and the creditor as at the time the debt was entered into. Although security interests in property other than real property will often be perfected by registration on the Personal Property Securities Register, there may be some security interests that are not registered or are not required to be registered in order to be perfected within the meaning of the Personal Property Securities Act 2009. Similarly, there may be security interests attached to real property that are not recorded on title. Failure to register a security interest does not automatically mean that the debt is not secured.

- Where a debtor is not the registered owner of property but has an equitable interest in that property, consideration will need to be given to whether the security confers upon the creditor the means of satisfying the debt owed by the debtor. That is, it is possible for a debt to be secured where the debtor is not the registered owner (the legal owner) of the property.

- There are some debts that the law deems secured, such as water supply charges and rates/land charges in certain locations. Some taxation debts may also become secured in certain circumstances.

- A shortfall (the difference between the amount owed to the creditor and the value of the property, as at the date a debt agreement proposal is accepted for processing and recorded on the National Personal Insolvency Index) is provable in a debt agreement, so this will need to be considered by the debtor and administrator when considering and preparing a debt agreement proposal.

- As the administrator is required to certify that, among other things, they are satisfied that the debtor will be able to discharge the obligations created by the agreement as and when they fall due, the administrator will need to have regard to the debtor’s obligations to making continuing payments to secured creditors while the debt agreement is active, as this may impact the total debt agreement payments that the debtor can realistically make. The administrator must also consider the potential for the secured creditor to repossess the secured property during or after the debt agreement if the terms of the loan (including repayments) are not satisfied, as well as the effect this will have on the debtor.

-

If a secured creditor realises its security while the agreement is in force, the (formerly secured) creditor is taken to be a creditor only to the extent of any outstanding provable debt. Any interest accrued on the debt after acceptance of the debt agreement proposal for processing cannot be recovered via the debt agreement.

- Example 1

- Zane entered into a debt agreement in November 2020. At this time, he had a secured motor vehicle loan. The debt agreement is scheduled to be completed in November 2022.

Zane stopped making his vehicle loan payments in May 2021. As a result, the creditor took possession of the vehicle in August 2021. At that time, the vehicle was sold for $10,000, which was applied to the loan. There was still $8000 owing.

In Zane’s debt agreement, the creditor is entitled to participate in dividends for the $8000 it is owed. All creditors’ dividends are adjusted to ensure that they are paid the same dividend rate. As Zane is no longer paying his secured loan, he may be able to increase his debt agreement payments and finish his debt agreement before November 2022.

-

Provable / non-provable

- A provable debt is one that entitles the creditor to vote on a debt agreement proposal and to participate in dividends paid. Section 82 of the Bankruptcy Act outlines which debts are provable and sections 83 to 107 provide further detailed information about provable debts.

- A creditor with a non-provable debt is not entitled to vote on a debt agreement proposal and does not have an entitlement to participate in dividends (i.e. the creditor does not receive any payments from the debt agreement). The debtor will remain liable for non-provable debts both during the term of the debt agreement and after the debt agreement has ended.

-

Extinguished / not extinguished

- Debts that are extinguished are those the debtor does not have a liability to pay after the terms of the debt agreement have been complied with and the debt agreement has been completed. Certain types of unsecured debts and shortfalls on secured debts that formed part of the debt agreement are extinguished when the debt agreement is completed – in effect, these debts end when the debt agreement is completed. If a debt agreement is not completed, for example if it is terminated, no debts are extinguished and the debtor is obliged to directly service whatever is remaining of the relevant debts.

- Debts that are not extinguished are those that the debtor will still have to pay both during the term of the debt agreement and after the debt agreement has ended. These debts include all non-provable debts, as well as some provable debts that the Bankruptcy Act specifically outlines as still being recoverable (such as child support debts).

-

Debts that are provable and extinguished that relate to ongoing services

- There are some debts that are provable and extinguished but, if not paid, will cause the loss of service as a consequence of non-payment. Examples include telephone, internet, pay television, school fees and motor vehicle registration.

-

Disclosing all debts on the explanatory statement and certification

-

A debtor is required to disclose all of their liabilities on the debt agreement explanatory statement, irrespective of the particular categories into which the debts fall.

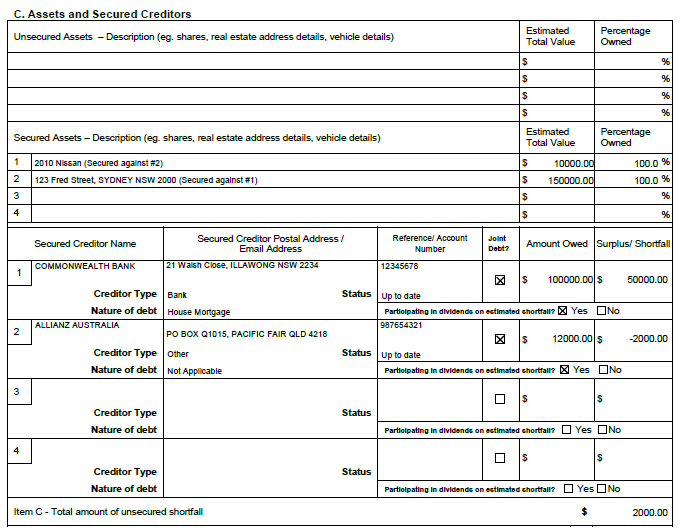

- Secured debts, such as mortgages and car loans, must be disclosed in Part C of the explanatory statement.

- Unsecured debts, such as credit cards, personal loans and unpaid bills, must be disclosed in Part D of the explanatory statement.

- Non-provable debts, such as unliquidated damages, must be disclosed in Part E of the explanatory statement.

- Contingent debts, where a liability to pay has not yet been called upon (such as a guarantee where the principal debtor has not defaulted so the guarantor isn’t required to make any payments or transfer property), are to be disclosed in Part E of the explanatory statement. (Where the debts have crystallised, they will need to be disclosed in Part C or Part D.)

- An example of how the explanatory statement should be completed when there are secured debts is available at annexure A.

-

More information about various categories of debts

- More information about the treatment of debts under the Bankruptcy Act is available in Treatment of debts in bankruptcy. Although written with a view to outlining how certain debts are treated in bankruptcy, the practice document has application to debt agreements as the provisions of the Bankruptcy Act in relation to provable debts apply equally.

-

-

The debt agreement proposal lodgement fee

- A debt agreement lodgment fee is provided for in clause 2.07 of the Bankruptcy (Fees and Remuneration) Determination 2015 and is payable at the time a debt agreement proposal is lodged with the Official Receiver. The lodgment fee is presently $200.

- Where the debtor received an eligible disaster recovery payment in the 12 months before lodgment of a debt agreement proposal, they will be exempt from payment of the lodgment fee. Eligible disaster recovery payments are specified in clause 2.07 of the Bankruptcy (Fees and Remuneration) Determination. No other exemptions apply.

- The Bankruptcy Act and Bankruptcy Regulations make no provision for refund of the fee.

-

Payment methods

- Payment of the lodgment fee can be made by credit card. Credit card payments can be made via debt agreements online.

- An administrator who does not have an account with AFSA will need to pay the fee prior to or at the time of lodgment of the proposal with the Official Receiver.

-

On account payments

- Administrators may apply to have accounts with AFSA and to have fees invoiced on a regular basis. All accounts must be paid in full by their specified due dates.

- Any disputes regarding an invoice issued to an administrator will need to be raised with the Official Receiver, who will decide whether the dispute has merit. If it is found that it does have merit, the error or dispute will be resolved on a subsequent invoice via issuance of a credit.

-

The lodgment fee on resubmission of a proposal

- Where a debt agreement proposal is not accepted by the Official Receiver to send to creditors for their vote, a refund will not be provided. A decision will be made whether the debtor will be permitted to resubmit the proposal (if they so choose) without having to again pay the lodgment fee. If a decision is made to allow the debtor to resubmit a proposal without having to pay, it is not automatic that the proposal will be accepted – the same considerations applied to original proposal will be applied to the resubmitted proposal.

- Situations where a debtor may be permitted to resubmit the proposal without having to pay the fee again may include where the proposal is not accepted because of a minor defect in the documents lodged. Examples of minor defects include an inconsistency in personal details between the documents, an incomplete answer to a question or a calculation error in an expected end date, the date of first dividend, a budget item, fees, dividends or realisations charge.

- The debtor will not be permitted to resubmit their proposal without having to pay the fee again where:

- it was not accepted for a reason other than a minor defect

- there are several clerical and/or calculation errors in the documents

- there are anomalies or inconsistencies relating to the signing and/or dating of the proposal

- they have already resubmitted a proposal for no fee.

- Where acceptance of a debt agreement proposal (the first proposal) by creditors is conditional on the acceptance of another proposal (the second proposal) and the second proposal is not accepted by the Official Receiver to send to creditors, the first proposal may be resubmitted for no additional lodgment fee. Whether or not the second proposal can be submitted without payment of the fee will depend on the reason(s) for it not being accepted.

- Where it is determined that a proposal may be resubmitted for no additional lodgment fee, it must be resubmitted within 30 days of the date that the Official Receiver advises that the original proposal has not been accepted.

-

Eligibility to make a debt agreement

- The eligibility criteria in the Bankruptcy Act that apply to debt agreements are:

- the debtor must be insolvent (subsection 185C(1))

- the debtor must not have been subject to an administration under the Bankruptcy Act in the preceding 10 years (paragraph 185C(4)(a)), and

- the debtor’s unsecured debts, property and income must be below statutory thresholds (paragraphs 185C(4)(b), (c) and (d)).

-

Insolvency

- While the administrator is responsible for certifying the debtor’s insolvency, the Official Receiver may seek clarification regarding certain factors that may indicate solvency, such as:

- the circumstances that led to the debtor becoming unable to pay their debts (for example, loss of employment)

- the status of unsecured debts (arrears, judgment etc.)

- the status of secured debts (for example, arrears, legal action having commenced, repossession etc.)

- the date the debtor was last able to pay their debts as and when they fell due, as advised by the debtor on their statement of affairs

- whether the debtor’s income is sufficient to pay their debts.

- Any additional information supplied by the administrator or the debtor that supports a conclusion as to the debtor’s insolvency is included as a comment in the Official Receiver’s report that is sent to creditors.

- If sufficient evidence is not available to support the conclusion that the debtor is insolvent, the debt agreement proposal will not be accepted.

-

Prior Bankruptcy Act proceedings

- A debtor is ineligible to lodge a proposal where, in the preceding 10 years, they have:

- been bankrupt

- been a party (as debtor) to a debt agreement, or

- signed a controlling trustee authority.

- When a debt agreement proposal is presented to the Official Receiver, a check of the National Personal Insolvency Index (“NPII”) is conducted using the debtor’s name, date of birth and any alias(es). (More information about the NPII is contained in part 13 of this document.)

- The relevant 10-year period in relation to an administration is as follows:

- in relation to a prior bankruptcy, the 10-year period runs from the date the bankruptcy ended

- for a previous debt agreement, the 10-year period runs from:

- where all debt agreement obligations have been discharged, the date of completion

- where the debt agreement was terminated by creditors’ resolution, the date of termination (section 185P of the Bankruptcy Act)

- where the debt agreement was terminated by the Official Receiver due to a designated 6-month arrears default, the date of termination (section 185QA of the Bankruptcy Act)

- where the debt agreement was terminated by the bankruptcy of the debtor (section 185R of the Bankruptcy Act), the 10-year period runs from the date the bankruptcy ends or ended

- for a section 188 authority under Part X (the precursor to a personal insolvency agreement), the 10-year period runs from the date the authority was signed.

- If the debtor was bankrupt and that bankruptcy was annulled by the Court under section 153B of the Bankruptcy Act (which provides for annulment where the Court is satisfied that a sequestration order ought not to be made or a debtor’s petition ought not to have been presented and accepted), that bankruptcy itself does not prevent the debtor from lodging a proposal. Likewise, a bankruptcy in a foreign jurisdiction does not prevent the debtor from lodging a proposal.

- If the debtor lodged a debt agreement proposal within the previous 10 years and that proposal was cancelled by the Official Receiver, the debtor has not been a party to a debt agreement and is entitled to lodge a new proposal if the other eligibility requirements are satisfied.

-

Unsecured debts limit

- A debtor is ineligible to make a debt agreement if they have unsecured debts above a monetary limit. The limit is indexed in March and September each year and can be found on the indexed amounts page on AFSA’s website.

-

The total unsecured debts include any shortfall between a secured debt and the value of the security.

- Example 2

- Ally owes a finance company $16,000 that is secured over a motor vehicle. The motor vehicle is presently worth $10,000. The finance company is an unsecured creditor in the amount of $6000, being the $16,000 owed less the $10,000 value of the secured property.

- Total unsecured debts are calculated at the time the debt agreement proposal is accepted for processing by the Official Receiver.

- The Official Receiver does not have the discretion to accept a debt agreement proposal if the debtor’s unsecured debts are above the limit, even if only by a small amount.

- Where there are inconsistencies in the information provided by the debtor on their proposal and explanatory statement, the Official Receiver may contact the administrator or debtor to ensure that the debtor has disclosed all unsecured debts owed and divisible property owned at the time of lodging the proposal. (More information about divisible property is contained below.) It is important to establish the amount of each debt at this time because, when statements of claim and voting are received from creditors, the amounts claimed are compared with the amounts disclosed by the debtor.

- The Official Receiver may seek clarification regarding a debtor’s total unsecured debts and confirmation that:

- the debt details shown on the debt agreement proposal are consistent with those details on the explanatory statement

- all debts are disclosed on the debt agreement proposal and explanatory statement, including debts that are not provable

- any shortfall for a secured debt shown in respect of a secured creditor on the explanatory statement is disclosed as an unsecured debt.

- Where there is an inconsistency between the debt agreement proposal and the explanatory statement that may suggest a discrepancy such as an understatement or non-disclosure of a debt, a telephone call is made to the administrator and/or to the debtor.

-

Value of the debtor’s property

- A debtor is ineligible to make a debt agreement if they have net divisible property worth more than a monetary limit. The limit is indexed in March and September each year and can be found on the indexed amounts page on AFSA’s website.

- Divisible property is property that, if the debtor became bankrupt, would be able to be sold by the bankruptcy trustee for the benefit of creditors. Divisible property does not include exempt or protected property. Net divisible property means the value of divisible property less amounts owed to secured creditors with valid claims.

- The Official Receiver does not have the discretion to accept a debt agreement proposal if the value of the debtor’s property is more than the limit, even if only by a small amount.

- The checks conducted regarding a debtor’s divisible property may include:

- confirming that divisible property shown on the statement of affairs is adequately disclosed on the explanatory statement

- establishing whether the property values disclosed appear to be reasonable and consistent with market values to ensure that property is disclosed at its true value

- checking whether the amount owed to a secured creditor may be overstated, which would mean that the net value of the secured property is understated.

- Where there is an inconsistency between the debt agreement proposal and the explanatory statement that may suggest a discrepancy, understatement or non-disclosure of property, a telephone call is made to the administrator and/or to the debtor.

-

After tax income threshold

- A debtor is ineligible to make a debt agreement if they have after tax income above a monetary limit. This limit is indexed in March and September each year and the current limit is available on the indexed amounts page on AFSA’s website. The after tax income limit is three-quarters of the unsecured debt limit.

- After tax income is defined in subsection 185C(5) of the Bankruptcy Act to be the total income to be earned in the coming year (from the time the proposal is given to the Official Receiver) less income tax and the Medicare levy imposed on that income. It is important to note that these are the only two deductions that are to be taken into account when assessing after tax income for these purposes. For instance, an amount the debtor pays for child support could not be included as a deduction when assessing after tax income.

- The Official Receiver does not have the discretion to accept a debt agreement proposal if the debtor’s after tax income is above the limit, even if only by a small amount.

- If the debtor earns business income, copies of current and projected income and expenditure statements, balance sheets and statements of business assets are expected to be held by the administrator and may be accessed by the Official Receiver to confirm the debtor’s eligibility or to clarify aspects of the proposal for creditors.

- The checks conducted to ensure all sources of income are disclosed include:

- confirming that the income shown on the explanatory statement does not exceed the limit

- verifying that the income and occupation shown on the explanatory statement are consistent with information on the debtor’s statement of affairs

- ensuring that income is not understated to make it appear that the debtor is eligible to make a debt agreement, when in fact they are ineligible

- ensuring that the income disclosed includes allowances, benefits, lump sum payments and other amounts that would normally be expected to be paid to a person in that occupation

- reviewing the inclusion of interest, dividends and rent from assets after deducting the expenses of earning that income

- reviewing the inclusion of income from any business(es) owned by the debtor after deducting all expenses directly attributable to that business

- ensuring that income is not understated to disguise from creditors the debtor’s true ability to pay their debts.

- Where significant unexplained differences are apparent between past and expected income and/or where the debtor discloses income inconsistent with their occupation, a telephone call is made to the administrator and/or to the debtor to obtain clarification and information.

-

Payment to income ratio

- Paragraph 185C(4)(e) of the Bankruptcy Act refers to a formula for calculating the ratio of the debtor’s payments under a debt agreement proposal to income, with reference made to a percentage determined by an instrument signed by the Minister.

- At this time, there isn’t an instrument specifying the percentage, and so the payment to income ratio is not presently a debt agreement eligibility consideration.

- The eligibility criteria in the Bankruptcy Act that apply to debt agreements are:

-

Conditional Proposals

- As subsection 185C(2E) of the Bankruptcy Act provides that a debt agreement proposal must not be given jointly by two or more debtors, proposals from two or more joint debtors may be made conditional upon all proposals being accepted by creditors to achieve release from joint debts.

- If proposals are conditional, both proposals are sent for voting at the same time to ensure that creditors, particularly joint creditors, can consider the proposals together.

- If both proposals are not received on the same day, processing is suspended until both proposals are able to be sent to creditors together.

- Where conditional proposals are accepted for sending to creditors for voting, all debtors’ conditional proposals must be accepted for all the debt agreements to come into force.

- Where a proposal is subject to the occurrence of a specified event within a specified period after the proposal is accepted by creditors, the period must not be longer than 7 days (pursuant to subsection 185C(2F) of the Bankruptcy Act). If the condition is unable to be satisfied within 7 days of the deadline date, the proposal will not be accepted.

- Where a proposal is subject to another form or condition, whether that condition has been satisfied is checked prior to deciding the vote result.

-

Conditions that are not acceptable

- A proposal conditional upon an event contrary to any provision of Part IX will not be accepted by the Official Receiver for processing. Examples include proposing that a particular creditor:

- not participate in dividends

- accept a different dividend rate to others in the proposal, or

- forgive a debt.

- Forgiveness of a debt by a creditor will need to be completed prior to the debt agreement proposal being lodged and not included as a condition in a proposal.

-

Considerations regarding accepting a debt agreement proposal for processing

- Where the Official Receiver is satisfied that the debtor is eligible to propose a debt agreement and that the debt agreement proposal lodgment fee has been paid, the Official Receiver must then be satisfied that the proposal complies with other legislative requirements before it can be accepted to send to creditors for voting.

-

Approved forms

- Subsection 185C(2) of the Bankruptcy Act requires that the proposal be in the approved form and subsection 185C(2B) requires that an explanatory statement in the approved form accompany the proposal.

- The administrator must submit one of two certificates, with the relevant certificate depending on the circumstances of the proposal. More detailed information about the certificate is contained below.

- The approved proposal form, explanatory statement, statement of affairs and certificate are available via debt agreements online.

-

Undue hardship

- The Official Receiver can refuse to accept a debt agreement proposal for processing if the Official Receiver reasonably believes that complying with the debt agreement would cause undue hardship to the debtor (see subsection 185E(2AB) of the Bankruptcy Act).

- Prior to the legislative changes in 2019, an administrator was already required to certify that the debtor was likely to be able to discharge the obligations created by the agreement as and when those obligations fall due. This certification will already prevent most agreements that would cause the debtor undue hardship. Accordingly, it would only be in exceptional circumstances that the Official Receiver would be called upon to consider whether to exercise this discretion not to send the debt agreement proposal to affected creditors for voting.

-

The term undue hardship is defined in section 111 of the Bankruptcy Regulations, which relates to requests to the Inspector-General for waiver or remission of charges, as follows:

- “…undue hardship means hardship that is unusual and exceptional in comparison to the hardship arising in the normal course of bankruptcy.”

- While this definition existed prior to the legislative changes in 2019 and it does not specifically reference debt agreements, the Official Receiver will consider in an undue hardship assessment whether the debtor is suffering or will suffer hardship beyond what would be experienced by any other person who seeks the protection of the Bankruptcy Act.

- While the Courts have not yet had the opportunity to consider the application of the Official Receiver’s power to reject a debt agreement proposal due to undue hardship, some principles established in case law regarding other matters include that the term does not lend itself to precise quantification and it is necessary to make an objective evaluation of the personal, family and financial circumstances of the debtor. This means that, because of each individual debtor’s unique circumstances (such as total debts, total amount offered under the debt agreement proposal, accommodation status – renting, buying or otherwise – and cost of that accommodation, income, number of dependants etc.), an exact quantitative measure cannot be put in place in order to determine whether a debtor will suffer undue hardship.

- The Official Receiver will reference the information provided in the debtor’s explanatory statement and make an assessment of whether the terms of the debt agreement proposal would result in the debtor being unable to service their and any dependants’ non-discretionary expenses, being the costs of:

- accommodation

- food

- medical treatment

- education

- basic utilities (water, electricity and gas).

- In circumstances where the Official Receiver has taken all factors apparent from the proposal into consideration and believes that compliance with the proposed agreement would cause the debtor undue hardship, attempts will be made to undertake reasonable enquiries with debtor and/or the administrator prior to making a decision.

- The power for the Official Receiver to refuse to accept a proposal for processing for undue hardship will also apply to a proposal to vary a debt agreement.

- In the case of both debt agreement proposals and variations, the power is discretionary and will not require the Official Receiver to review every lodgment.

-

Duration of the agreement

- There are maximum durations for debt agreements:

- if the debtor has an interest in their principal place of residence[3] and they are not undertaking to sell that property for the duration of the proposed debt agreement, the proposal may provide for a maximum of a 5-year debt agreement. The 5-year period starts from the day the debt agreement is made

- a debtor who does not have an interest in their principal place of residence may lodge a proposal that provides for a maximum of a 3-year debt agreement. The 3-year period starts from the day the debt agreement is made.

-

Signing and dating the forms and lodging within 14 days

- The proposal must be lodged within 14 days of the debtor signing and dating the proposal and associated documents to ensure that the information for creditors is current and that it accurately discloses the debtor’s current circumstances.

- In cases where there is doubt about whether the debtor has signed a complete document or has signed a changed document, a telephone call to the debtor is made to confirm whether or not the debtor signed the complete document that was lodged and is aware of all the information in the document.

- It is essential for the debtor to view all completed pages before signing the documents to ensure that accurate information is provided to creditors and because the debtor may commit an offence if they provide false or misleading information.

- The signature may be electronic or a scanned copy of an originally signed document. Either way, the signature should appear on the documents as it appears on the debtor’s identification documents. The administrator is required to retain a copy of the signed document, regardless of the method of signing.

-

Certificate from the administrator

- The administrator, when consenting to act, is required to provide a certificate to the Official Receiver. Where the proposal is accepted for sending to creditors for their vote, the certificate is also sent to creditors.

- There are two certificates, with the applicable certificate depending on the circumstances of the proposal:

- where the amount offered under the proposal and the debtor’s income do not exceed the payment to income ratio, certificate 1 is to be used

- where the amount offered under the proposal and the debtor’s income do exceed the payment to income ratio, certificate 2 is to be used. This will require the administrator to certify that they are satisfied that the debtor can maintain the payments under the debt agreement proposal.

- Both certificates provide for the following:

- confirmation that the administrator consents to act as the administrator of the debt agreement

- that the administrator has given the debtor a copy of the prescribed information, which summarises the options available to manage debts and the consequences

- that the administrator has reasonable grounds to believe that the debtor is likely to be able to make the payments offered in the debt agreement

- that all information required to be set out in the debtor’s statement of affairs, debt agreement proposal and explanatory statement have been set out, and

- that the administrator has reasonable grounds to believe that the debtor has fully disclosed the information required to be disclosed on the forms.

- The certificate from the administrator must also disclose the details of any broker or referrer relationships, including any payments made for any referrals. In addition, the certificate must declare whether the proposed administrator is also an affected creditor and whether any other affected creditors are also related entities of the administrator.

- Where the proposal exceeds the prescribed payment to income ratio, the administrator may certify that the payments are viable despite this. The administrator may certify that they are satisfied that the debtor is likely to be able to make the payments offered in the agreement.

- The obligation to certify that the administrator has reasonable grounds to believe that all the information required to be set out in a debtor’s statement of affairs and explanatory statement has been set out in those documents extends to ensuring that secured creditors are disclosed and the values of secured property and secured debts are accurately stated. The administrator should not rely on the debtor’s opinion as to the market value of secured property and, instead, is expected to obtain corroboration from an independent source. What is appropriate corroboration will depend upon the nature of the asset and the circumstances of the case and may include online reviews of the prices of similar properties listed for sale, an online appraisal of the value of a vehicle or the administrator’s own personal knowledge. A formal valuation is not necessarily required.

- More details about certification can be found in Debt agreement administrators’ guidelines to certification requirements.

-

Proposal only provides for transfer of money to creditors

- A debt agreement proposal must not provide for the transfer of any property other than money to creditors (subsection 185C(2A) of the Bankruptcy Act).

-

Where the proposal is not in the interests of creditors

- The Official Receiver must not accept a debt agreement proposal to send to creditors for voting where creditors’ interests would be better served by the proposal not being accepted for processing (subsection 185E(3) of the Bankruptcy Act). In exercising this discretion, the Official Receiver is not making a decision about whether the debt agreement would be in the interests of creditors; rather, the discretion merely ensures that creditors are able to vote on an informed basis.

- Although it is not possible to be definitive as to the circumstances when the Official Receiver would exercise this discretion, examples of where it may be exercised are where:

- a debtor’s affairs are so complex that they result in a lack of clarity for creditors. In such a situation, consideration is given to whether creditors’ interests are better served by not sending a proposal for their vote. Bankruptcy or a personal insolvency agreement may be a better option to enable the debtor’s affairs to be fully investigated

- the proposal is not likely to be understood by creditors. In this situation, before rejecting a proposal the Official Receiver will make a telephone call to determine if the proposal is capable of being understood by creditors with the addition of a comment in the Official Receiver’s report to creditors

- information is available or becomes available to suggest that the debtor has income, property and/or liabilities that have not been disclosed in the proposal.

- The power for the Official Receiver to refuse to accept a proposal for processing where creditors’ interests would be better served by not accepting the proposal also applies to proposals to vary a debt agreement. This discretion may be exercised in relation to variation proposals where the proposal seeks to extend the length of the agreement beyond 3 years and there is insufficient or incomplete information to support the grounds for extension.

-

Where the debtor has only one creditor

- The debt agreement system is not generally meant for a debtor who has only one creditor because they are able to negotiate with the creditor or access the creditor’s hardship provisions. In most cases, it is not appropriate to ask a single participating creditor to vote on something that is essentially an agreement that should be reached directly with the debtor.

- Where a debt agreement proposal involving a single creditor is lodged, it will not be accepted for processing unless the debtor is able to establish that there are exceptional circumstances that would justify accepting it. Some examples of what may constitute exceptional circumstances are where:

- a debtor has only one creditor, and their partner is also proposing a debt agreement and has multiple creditors. This may be considered exceptional as it may be the only way that the debtors are able to manage their joint financial affairs

- the single creditor has advised the administrator that they are interested in reviewing the debt agreement proposal and participating in the voting process.

- As subsection 185E(3) of the Bankruptcy Act does not permit the Official Receiver to accept a proposal when the interests of creditors will be better served by them not accepting the proposal, where a single creditor proposal is received the Official Receiver will notify that creditor and advise that it is proposed to not accept the proposal. The Official Receiver will allow the creditor 2 business days to respond.

-

Person authorised to deal with property

- Where a debt agreement proposal authorises a person to sell or deal with property, the proposal will not be accepted unless the person is a registered administrator or trustee, or unless the Official Receiver is satisfied that the person passes the basic eligibility test.

-

Resubmitted proposals

- Major creditors have indicated that they are unwilling to vote for the same proposal on resubmission unless there is an additional benefit to them or the creditors have indicated that they are prepared to reconsider the proposal in its original form.

- The resubmitted proposal is compared to the previous proposal(s) to understand the extent to which the original proposal has changed and any different benefit to the creditors. The resubmitted proposal will only be accepted and sent for voting if:

- there is an increase in the estimated dividend to creditors or another benefit to them, and/or

- the creditors have stated that they will reconsider the proposal in the same form.

- A fresh eligibility check is performed when a proposal is resubmitted, which involves the same checks applied to the initial proposal, for example that the administrator is still eligible, the thresholds are not exceeded etc.

- A resubmitted proposal will not be accepted if:

- there is an issue that has not been addressed from a previous proposal unless the matter is clarified in a telephone call made to the debtor or proposed administrator, and/or

- it is a straightforward resubmission without a change or a statement on the explanatory statement that creditors have agreed to reconsider and accept the proposal.

-

Review of decision to not accept a proposal

- The debtor may apply to the Administrative Appeals Tribunal for a review of the Official Receiver’s decision to not accept a debt agreement proposal for processing.

-

Withdrawal, cancellation, or lapsing of a debt agreement proposal

-

Withdrawal by the debtor

- The Bankruptcy Act does not prevent a debtor from withdrawing their proposal before or during the voting period. Such a withdrawal must be in writing and must be given to the Official Receiver prior to the voting deadline date. The debtor does not need to supply a reason for the withdrawal.

-

Cancellation by the Official Receiver

- Where a debt agreement proposal was accepted for processing and the voting deadline has not yet passed, section 185ED of the Bankruptcy Act allows the Official Receiver to cancel the proposal (see part 9 below).

-

Lapsing of a debt agreement proposal

- Section 185G of the Bankruptcy Act provides that a debt agreement proposal lapses if:

- the Official Receiver accepts the proposal for processing and writes to affected creditors about it, but no replies are received before the applicable deadline, or

- the debtor dies after giving a debt agreement proposal to the Official Receiver and before the proposal is accepted by creditors.

-

-

Voting

-

The voting process

- If the debtor is eligible to make a debt agreement and the proposal complies with legislative requirements, the Official Receiver sends to each secured and unsecured creditor:

- the proposal

- the explanatory statement

- a report

- details about lodging a claim and vote form (“CAV”) online.

- The right of a creditor to vote and the amount for which they may vote is initially based on the documents provided by the debtor and may be reviewed when the completed CAV is returned by the creditor. It is the Official Receiver’s responsibility to assess a creditor’s eligibility to vote on the proposal.

- Each creditor may vote “yes” or “no” or may abstain. By lodging a completed CAV, the creditor can provide details of their claim for dividend purposes.

- In order to validly vote, the CAV must be completed and returned by the voting deadline date to establish all the following information:

- whether the party is in fact a creditor

- the amount of unsecured debt

- in relation to a secured debt, the value of the security and the net amount (i.e. the unsecured portion) owed

- whether the creditor is a related entity and, if so, the amount of the purchase price of the debt

- whether the creditor voted yes or no or abstained.

- The creditor is given the option to provide a reason as to why they voted in a certain way. The creditor is also given the option to have this reason disclosed to the administrator.

- The voting deadline date is provided for in section 185 of the Bankruptcy Act and is 35 days after the date on which the Official Receiver accepted the proposal to send to creditors for voting or 42 days in December.

- A CAV received after the end of the deadline date cannot be accepted.

-

Eligibility to vote and amount for which the creditor may vote

- To be eligible to vote, a creditor must have a provable debt – either an unsecured debt or an estimated shortfall on a secured debt – at the time the acceptance of the debt agreement proposal was recorded on the NPII. Interest is calculated to this date and must be rebated if the contract provides for lump sum interest over the life of the loan.

- For debt agreement proposals lodged on or after 27 June 2019, the Official Receiver must not request a vote from a proposed administrator that is also an affected creditor or from a related entity of the proposed administrator. This also applies to proposals to vary or terminate a debt agreement, where the original debt agreement proposal was given to the Official Receiver on or after 27 June 2019 (but not to a variation or termination proposal given to the Official Receiver before this date).

- Where a party who submits a CAV appears to be claiming an assigned debt, it is for the Official Receiver to determine whether they are an affected creditor who is entitled to participate in the debt agreement and voting process. The Official Receiver will verify that an assignment has occurred and will decide the value of the vote based on the information provided by:

- the debtor on their explanatory statement and statement of affairs

- the creditor on their CAV

- contacting the administrator, including referencing documents held by the administrator

- contacting the debtor and/or creditor.

- The amount claimed by a creditor may vary from the amount disclosed by the debtor. Where there is a difference and it is material, a telephone call is made to the creditor and/or debtor to assist in deciding the amount of the creditor’s vote.

- Where a debt has been assigned to a related entity of the debtor, as defined in section 5 of the Bankruptcy Act, that entity may only vote for the amount that was paid for the assignment of the debt.

- If the debtor or administrator disputes the eligibility of a creditor to vote on the debt agreement proposal, this will need to be brought to the attention of the Official Receiver for consideration during the voting period.

- The Bankruptcy Act makes it an offence for an administrator to give, agree to give or offer to give an affected creditor an incentive for voting a certain way on a debt agreement proposal or on a variation or termination proposal.

-

Secured creditors

-

A secured creditor is entitled to vote for the shortfall after deducting the value of security or for any actual shortfall after repossession and sale.

- Example 3

- Ally owes a finance company $16,000 that is secured over a motor vehicle. The motor vehicle is presently worth $10,000. The finance company is entitled to vote on the proposal in the amount of $6000.

- If there is doubt as to whether the value given to the security reflects the market value after taking into account expenses of repossession and sale, the Official Receiver may request further information.

- Any decision by the Official Receiver as to the amount for which a secured creditor is permitted to vote is not binding on the administrator when the administrator assesses the secured creditor’s entitlement to participate in dividends.

-

Subsection 185C(2) of the Bankruptcy Act also provides that creditors are not entitled to receive more than the amount of their provable debt. This may require amendments to the value of securities. Administrators must ensure that, where secured creditors are still receiving payments from the debtor, payments are not made to secured creditors with respect to the unsecured portion of their claims if the claims of the secured creditor have been satisfied in full.

- Example 4

- When Wendell lodged his debt agreement proposal, he had a secured car loan with $20,000 owing. Wendell and the creditor believed the car to be worth $11,000. The creditor was permitted to vote on the debt agreement in the amount of $9000. Following increases in the price of second hand vehicles, the creditor believes during the debt agreement that the vehicle is now worth $14,000. As such, the creditor is only entitled to participate in dividends for the $6000 shortfall. If the creditor had already received $6000 in dividends from the debt agreement, it would not be entitled to receive further dividends.

- A secured creditor can choose not to accept debt agreement dividends and, instead, rely on direct payments made by the debtor. A secured creditor is in a different position to unsecured creditors in this regard, and the secured creditor could choose to only assert its right to participate in dividends in the debt agreement if the debtor defaults and the secured creditor subsequently repossesses its security and suffers a shortfall. Irrespective of what a secured creditor choses to do in relation to dividends, it will still be a party to the debt agreement and the debtor will still be required to disclose details of the secured creditor on their debt agreement forms. The secured creditor will still be bound by the debt agreement and the debt will be extinguished upon completion of the debt agreement, except in respect of the rights to deal with the security (i.e. a secured creditor can realise its security after the completion of a debt agreement, although it won’t be able to pursue the debtor for any shortfall).

- If it is anticipated that a secured creditor will not be accepting dividend payments, this should be disclosed by the debtor on their debt agreement forms.

-

Where an undisclosed creditor(s) become known during the voting stage

- If a creditor who lodges a CAV was not disclosed on the debt agreement proposal, a telephone call is made to the creditor and/or debtor to assist in deciding whether the creditor has a provable debt and the value for which they may vote.

- Where the unsecured debt of an undisclosed creditor is material or there is a material difference in the amount claimed compared to the amount disclosed by the debtor (for example, where the amount may materially reduce the estimated dividend), the proposal will be cancelled.

-

Changing a vote

- To change their vote, the creditor can lodge a fresh CAV prior to the deadline date.

-

Determining the result

- When a CAV passes all compliance checks, the vote is recorded and is verified the day after the deadline.

- The vote result is based on a majority in value of the unsecured debts of creditors who are eligible to vote and who lodge a valid vote on a CAV, excluding any votes from the administrator and/or related entities.

- Information on the progress of voting is not provided to any party. However, the debtor or an affected creditor may apply to the Official Receiver to make arrangements to inspect, or obtain a copy or extract of, a CAV.

- The debtor, creditors and administrator are notified of the voting outcome.

- The voting result is recorded on the NPII as a debt agreement or rejection of the proposal.

-

-

Cancellation of a debt agreement proposal by the official receiver

- The Official Receiver has discretion to cancel a debt agreement proposal during the voting period on the basis of non-disclosure of information or the provision of incorrect information on the proposal and/or explanatory statement on which the creditors are relying when making a decision.

- As discussed above, the proposed administrator is required to lodge a certificate with the proposal certifying that they have reasonable grounds to believe that all the information required is disclosed. For this reason, there should be few instances where a proposal is cancelled for reasons of non-disclosure.

- A proposal will be cancelled if any of the following provisions apply:

- an affected creditor has not been disclosed on the statement of affairs and the non-disclosure has a material effect on the proposal

- material information has been omitted or is incorrect on the statement of affairs or explanatory statement

- there has been a material change in the debtor’s circumstances that was not foreshadowed on the statement of affairs and explanatory statement that, in the opinion of the Official Receiver, is capable of affecting a creditor’s decision (or several creditors’ decisions)

- any other information has come to light that, if it was known at the time the proposal was accepted for processing, the proposal would not have been accepted (including information that means the debtor was not eligible to propose a debt agreement).

- In determining what is “material”, the impact as a whole is assessed as well as:

- whether there is a material reduction in the estimated dividend to creditors

- whether the total unsecured debt exceeds the limit

- the proportion of the total of the undisclosed unsecured debt to the total unsecured debt

- non-disclosure of property or understatement of the value of divisible property and whether total property exceeds the limit

- understatement of income and allowances or the omission of employment, and whether income exceeds the limit

- overstatement of household expenses and/or an incorrect statement of the number of dependants, and whether this affects ability to pay.

- If a proposal is cancelled, a debtor is able to submit a new proposal, provided they are eligible. In any new proposal, the debtor must amend their proposal to overcome the reasons for the cancellation, otherwise it will not be accepted for processing. The lodgment fee will need to be paid again when the new proposal is lodged.

- The debtor and creditors are notified of the cancellation and rights of review. A copy of the notification is sent to the administrator.

- The debtor may apply to the Administrative Appeals Tribunal for review of the decision to cancel.

-

Completion of a debt agreement

- A debt agreement is completed when all obligations under the agreement have been satisfied, including the debtor having made all payments under the debt agreement and the administrator having distributed all money.

- For debt agreements resulting from proposals lodged on or after 1 July 2007, the debtor must complete their obligations to achieve a release from the provable and extinguished debts owed to the creditors that are bound by the debt agreement.

-

Statement of receipts and payments

- The administrator must provide the Official Receiver with a statement of receipts and payments showing the total amount paid by the debtor, any sales of property, total fee and expense payments and total dividends to creditors. The statement of receipts and payments is checked against the original or varied agreement to confirm that the debtor has paid all amounts due under the agreement, property offered has been sold and accounted for and/or that the debtor has otherwise completed all obligations under the agreement.

- If the amount recorded as being received in the statement of receipts and payments is less than the amount payable under the agreement or varied agreement, completion cannot be recorded.

-

Recording completion of the agreement

- The administrator must notify the Official Receiver on the notice of completion of debt agreement form within 5 working days of the debtor completing all payments and obligations under the debt agreement.

- Completion of a debt agreement is only recorded on the NPII when the Official Receiver is satisfied with the evidence of completion.

- When completion has been verified and the NPII updated, the debtor and administrator will be notified.

-

Variation and termination

-

Proposal to vary a debt agreement

- A proposal to vary a debt agreement generally arises from a change in the debtor’s circumstances, for example:

- a change in income resulting in a reduction or increase in the amount they can afford

- an increase in the number of dependants, such as an additional child

- the loss of a partner’s income

- an increase in household expenses

- a loss on repossession of secured property during the debt agreement resulting in an increased value of provable debts

- an increase in income from a new job resulting in an ability to increase in payments

- support from a third party to assist with payments

- the ability of the debtor to offer a lump sum to complete the agreement.

- Only a debtor or, in limited circumstances, an affected creditor may lodge a proposal to vary a debt agreement. An administrator may only lodge a proposal to vary if they are also an affected creditor.

- A variation proposal must be accompanied by a certificate signed by the administrator stating that the debtor is likely to be able to discharge the obligations created by the agreement (as proposed in the variation) as and when they fall due.

- The proposal to vary, accompanying explanatory statement and certificate must be submitted electronically via debt agreements online or AFSA’s Business to Government channel.

- The difference between the original agreement or a later variation (if applicable) and the variation being proposed must be sufficiently clear to ensure that creditors are well informed when they vote.

- If the difference or the variation is unclear, a telephone call is made to the debtor and/or administrator. If additional information or an explanation would clarify the position for creditors, the variation proposal will be returned to the submitting party to amend. Alternatively, the variation proposal may be rejected by creditors on the basis of there being a lack of clarity and/or it not being in the interests of creditors.

- The Official Receiver will examine the explanatory statement accompanying the variation proposal to ensure that the changes to the debtor’s circumstances are fully disclosed and are consistent with the proposal to vary the debtor’s payments. The explanatory statement should include details of positive and negative changes to the debtor’s circumstances. This ensures that, where there are multiple changes, these can all be considered by creditors. Where there is an inconsistency, a telephone call is made to the debtor.

-

Variation proposed by a creditor

- There are a limited number of instances where a creditor may propose a variation that does not affect the payments and obligations of the debtor (for example, proposing to change the administrator – see below).

- Where a creditor has proposed a variation relating to payments made or actions undertaken by the debtor, it is not practical for this to be accepted for processing unless the creditor can establish that there has been negotiation with the debtor to ensure that the debtor will be able to complete the varied agreement. This means that a variation proposal that is lodged by a creditor relating to payment or action by the debtor without documented agreement by the debtor will not be accepted to send to creditors for voting.

- Telephone calls are made to the debtor and administrator to establish whether agreement has been obtained. A telephone call is made to the creditor explaining the practicalities of proposing such a variation without agreement by the debtor. An alternative is for the creditor to persuade the debtor to lodge their own variation proposal.

-

Variation to change the administrator

- A proposal to change the administrator must be accompanied by a consent to the appointment signed by the proposed administrator. The proposal will not be accepted unless the proposed administrator is a registered administrator or registered trustee.

-

Accepting a variation proposal for processing

- If a proposal to vary has already been rejected by creditors, a further proposal to vary in the same terms will not be accepted unless creditors have indicated that they will reconsider this variation. If a fresh proposal provides for a material benefit to creditors, it is sent for voting.

- If completion of the debt agreement occurs before the proposal to vary voting deadline, the debt agreement is completed.

- If a 6-month arrears default occurs before the voting deadline date for the proposal to vary, the debt agreement is terminated.

- It is not a valid reason to extend the length of the debt agreement if the debtor simply finds the debt agreement payments to be unaffordable without any change to their circumstances (i.e. where the agreement was unaffordable to begin with).

- Where a debt agreement proposal was given to the Official Receiver on or after 27 June 2019, a proposal to vary it cannot have the effect of extending the timeframe for making payments under the agreement beyond 3 years from the original agreement date, or 5 years in the following circumstances:

- If the debtor was exempt from the 3-year limit at the original proposal time because they had an interest in their principal place of residence, they are still exempt from this when proposing to vary their debt agreement. The agreement may therefore last up to 5 years from the original agreement date.

- The debtor may seek to extend the length of the agreement to up to 5 years from the original agreement date if they have suffered a substantial change in circumstances after the debt agreement was made, that was unforeseen at the time and makes them unlikely to be able to discharge their obligations. The debtor is required to provide details of the change in circumstances in the proposal to vary the agreement. The administrator is required to certify that the debtor meets the conditions to extend the length of their agreement for this reason. In this case, a variation cannot seek to extend the length of the debt agreement and also increase the total payment amount to be made by the debtor.

-

The Official Receiver may reject a proposal to vary a debt agreement if the Official Receiver reasonably believes that the agreement as proposed to be varied would cause undue hardship to the debtor. This is applicable only to proposals to vary agreements where the original debt agreement proposal was given to the Official Receiver on or after 27 June 2019. For considerations regarding the Official Receiver’s power to reject a proposal to vary for this reason, see above.

- Example 5

- Edwin lodged a debt agreement proposal a year ago, in which he undertook to pay $500 per week to his creditors. He later lost his job and submitted a variation, offering creditors $75 per week from his social security benefits. With reference to the maximum basic rates of pension, it would be difficult to conclude that the $75 per week offered by Edwin in his varied agreement would not have a significant impact on his ability to meet his other non-discretionary expenses.

- The Official Receiver may reject a proposal to vary a debt agreement if the Official Receiver thinks that creditors’ interests would be better served by not accepting the variation proposal for processing. This is applicable only to proposals to vary agreements where the original debt agreement proposal was given to the Official Receiver on or after 27 June 2019. In exercising this discretion, the Official Receiver is not making a decision about whether the proposal to vary the agreement would be in the interests of creditors; rather, the discretion merely ensures that creditors are able to vote on an informed basis. The Official Receiver may exercise this discretion if insufficient or incomplete information has been provided to support extending the length of the debt agreement.

-

Review of a decision to not accept a variation proposal for processing

- The debtor may apply to the Administrative Appeals Tribunal for a review of the Official Receiver’s decision to not accept a variation proposal for processing.

-

Voting period

- The voting deadline date is 35 days after the date on which the Official Receiver accepted the variation proposal to send to creditors for voting or 42 days in December.

-

Proposal to terminate a debt agreement

- A debtor or creditor may propose termination of a debt agreement. The following are examples of the types of situations that may prompt a proposal to terminate:

- the failure of the debtor to start or maintain payments with little likelihood of completing the debt agreement

- a change to the debtor’s circumstances where they can no longer afford payments and a variation to reduce payments is not feasible

- material non-disclosure of employment or income that would have affected the creditors’ original decision to support a debt agreement

- a material reduction in the estimated dividend to creditors because of significant undisclosed debt

- a material omission of divisible property that would have affected the creditors’ original decision to accept the debt agreement.

- Only a debtor or a creditor who is a party to the debt agreement may lodge a proposal to terminate a debt agreement. An administrator may only lodge a proposal to terminate when they are an affected creditor.

- The proposal to terminate and accompanying explanatory statement must be submitted electronically via debt agreements online or AFSA’s Business to Government channel.

- While the reasons for proposing termination are not prescribed, a proposal to terminate would generally only be appropriate where the debtor has failed to perform the terms of the debt agreement or failed to disclose material information that affected creditors’ original vote.

- A creditor lodging a proposal to terminate must obtain and lodge with the proposal a status report from the administrator showing whether the payments are up to date, the amount of arrears and the likelihood of the debtor continuing payments to complete the debt agreement.

- A proposal to terminate without a current status report will not be sent for a vote until the creditors can be given an up-to-date report on the agreement.

- The practice of obtaining a status report with a proposal to terminate is aimed at ensuring that agreements that are up to date are not terminated. Creditors must be kept informed by the administrator if an agreement is in arrears and should communicate with the administrator to ensure they are adequately informed before considering a termination.

- If a proposal to terminate is lodged by a creditor when payments by the debtor are up to date and no other reason is provided for the proposal on the form, it will not be processed. This means that a reason(s) must be provided in the explanatory statement section of the form, such as non-disclosure of income, debts or property that materially affect the dividend rate to creditors. Creditors not having received dividends from the debt agreement may not be a valid reason because payment of a dividend is the responsibility of the administrator. Where there is no valid reason provided, a telephone call is made to the debtor, administrator or creditor to clarify the reason prompting the proposal to enable the Official Receiver to report to creditors. If additional information would clarify the position for creditors, the proposal will be returned to the submitting party to amend.

- If a debtor lodges a proposal to terminate, they must be adequately informed of the consequences of termination. The debtor will be ineligible to propose another debt agreement for 10 years.

- The debtor may propose a termination to be released from the debt agreement to enable them to lodge a debtor’s petition to become bankrupt.

- If the proposal to terminate is received from a creditor who is not disclosed in the proposal, the creditor should provide both a status report from the administrator and evidence to establish that the creditor is a party to the debt agreement.

- If a proposal to terminate has already been rejected by creditors, a further proposal to terminate is not accepted unless creditors have indicated they will reconsider a termination or there has been a significant change in the debtor’s circumstances.

- If completion of the debt agreement occurs before the deadline date for the proposal to terminate, the debt agreement is completed.

- If a 6-month arrears default occurs before the deadline date for the proposal to terminate, the debt agreement is terminated on that basis.

-

Voting period

- The voting period is 14 days, except in December when it is 21 days.

-

If creditors vote to terminate

- If a debt agreement has been terminated, the debt agreement will be recorded on the NPII as terminated and cannot be recorded as completed. This is the case regardless of whether there is an informal arrangement with the debtor to continue making payments.

-

Withdrawing a proposal to vary or terminate

- A debtor or creditor may withdraw a proposal to vary or a proposal to terminate prior to the voting deadline date.

- The Official Receiver has the discretion to withdraw a proposal to vary or terminate if there are material reasons for doing so.

- The Official Receiver may withdraw a proposal to vary or terminate upon becoming aware that the explanatory statement was deficient because:

- it omitted material information or was incorrect in a material particular, and/or

- a material change in circumstances that was not foreshadowed is capable of affecting a creditor’s decision whether to accept or not to accept the proposal.

- The Official Receiver must give the debtor and all parties to the debt agreement notice of any withdrawal of a proposal.

- If the Official Receiver decides to withdraw a proposal to vary or terminate, the debtor or an affected creditor may apply to the Administrative Appeals Tribunal for a review of the decision.

-

Six-month arrears default termination of a debt agreement

- Six-month arrears default occurs when:

- a debtor does not make any payment for 6 months after the date a payment is due

- a debtor has not completed all payments and obligations within 6 months after the completion date of the agreement.

- A 6-month arrears default terminates a debt agreement and compliance checks are made to ensure that the debt agreement is validly terminated before it is recorded on the National Personal Insolvency Index.

- A debt agreement administrator must notify the Official Receiver on the approved form within 10 working days if there has been a 6-month arrears default by the debtor.

- An administrator must provide the completed form to Official Receiver with evidence of the 6-month arrears default including:

- details of amounts and dates due in relation to the payments by the debtor under the debt agreement

- a list of payments by the debtor showing the total arrears and the date of the last payment

- the date of completion on the original or varied agreement.

- This information is checked to confirm that a 6-month arrears default has occurred. Where the Official Receiver is satisfied that this has occurred, the termination will be recorded on the NPII.

- In determining a 6-month arrears default, there is no discretion where evidence proves that a default has occurred. Termination occurs and the NPII must be updated.

- If there is doubt or a dispute about whether default has occurred, a telephone call is made to the debtor and/or administrator to verify it.

- An agreement is terminated when the 6-month arrears default is entered on the NPII.

- The debtor and creditors are notified of the termination by the Official Receiver with a copy to the administrator.

-

-

Replacing a debt agreement administrator

- Where there is a vacancy in the office of administrator for one of a number of reasons, either the Official Trustee in Bankruptcy becomes the administrator of a debt agreement or the Official Receiver may appoint another person to be the administrator of the debt agreement in place of the Official Trustee.

- The creditors or the debtor may propose the appointment of another person as administrator through a proposal to vary the debt agreement.

- If a debt agreement administrator dies, the administrator of the estate of the deceased person must notify the Official Receiver as soon as practicable. If AFSA’s Enforcement and Practitioner Surveillance division is notified of the death, the Official Receiver is informed immediately.

- Once evidence of death (e.g. a copy of the death certificate) is received, the Official Receiver will update the NPII to show that the Official Trustee is the administrator.

- When the Official Receiver is notified that there is a vacancy in the office of an administrator for any reason, the debtor and creditors will be notified that the Official Trustee is the replacement administrator or, if the Official Receiver intends to appoint another person as administrator, the debtor and creditors will be so notified.

- In considering whether to appoint an administrator in place of the Official Trustee, the Official Receiver will take into account:

- the reasons for the administrator ceasing registration, becoming ineligible or being removed

- the state of the affairs of the administrations handled by the administrator, including whether a reconciliation or reconstruction of accounts is necessary

- the views expressed by any major creditors and individual debtors.

- When notified of the Official Trustee becoming the replacement administrator, creditors and the debtor may lodge a proposal to vary the agreement by appointing another person and the creditors would be given the opportunity to vote.

-

The National Personal Insolvency Index

- The National Personal Insolvency Index (“NPII”) is a publicly available electronic record of certain personal insolvency proceedings in Australia. Its creation and maintenance are provided for in Part 13 of the Bankruptcy Regulations 2021.

- When a debtor gives a debt agreement proposal to the Official Receiver and this is accepted for processing, a NPII record will be created. The record lists the debtor’s name, any aliases, date of birth, address at date of lodgment of the proposal and occupation. The date the proposal was given and the type of insolvency proceeding is also recorded.

- The debt agreement proposal recorded on the NPII will be updated to reflect the voting outcome (i.e. the making of the debt agreement or the rejection of the proposal by creditors). Alternatively, if the proposal is withdrawn, the NPII will be updated with this information.

- Where a debt agreement is made, the particulars of the debt agreement administrator are recorded on the NPII. If the debt agreement administrator changes, the new administrator’s name and contact details and date of appointment are recorded.

- When a debt agreement is completed, cancelled or terminated, the status is updated on the NPII.

-

The National Personal Insolvency Index and requesting suppression of information

- A debtor may apply to have their address and/or occupation suppressed, (meaning not entered), on the NPII either at the time of presenting a proposal or later.

- An application to have information suppressed must be made in writing to the Inspector-General.

- The Inspector-General will consider all requests made in writing.

- While supporting documents will assist in the assessment of an application, the provision of such information by the debtor is not mandatory. The administrator of a debt agreement must be notified immediately by the Inspector-General when a suppression application is approved. The notification will set out the effect of a suppression decision on the administration of the debt agreement.

- More information about the NPII and NPII suppressions can be found in The National Personal Insolvency Index as well as AFSA’s website.

-

The National Personal Insolvency Index and the normal timeline for removal of records