On this page

How do the reforms affect debt agreements lodged prior to 27 June 2019?

Most of the changes from the debt agreement reforms will not impact debt agreements which were lodged with AFSA prior to 27 June 2019, unless you were administering your own agreement or were using an unregistered debt agreement administrator.

These types of debt agreements that commenced prior to 27 June 2019 will automatically transfer to the Official Trustee (AFSA) on 27 September 2019. If you don’t want AFSA to manage your debt agreement, you need to select a registered debt agreement administrator or registered trustee prior to 27 September 2019.

How do the reforms affect a debtor’s eligibility to enter into a debt agreement?

Payment to income ratio

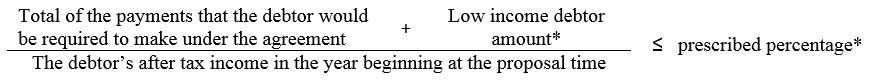

The reforms prevent a debtor from giving the Official Receiver a debt agreement proposal if the total proposed payments under the agreement (over the life of the agreement) exceed the debtor’s yearly after-tax income by a prescribed percentage (the payment to income ratio). Total payments include payments to creditors, the administrator’s remuneration and the realisations charge. A fixed amount, the low income debtor amount is also incorporated into the ratio (illustrated below):

* The Attorney-General can prescribe both the prescribed percentage and the low income debtor amount by legislative instrument. These amounts will be worked out by the Attorney-General’s Department in close consultation with industry groups and stakeholders.

Debt agreement variations must also comply with the payment to income ratio.

The ratio is intended to act as a safeguard for vulnerable debtors while at the same time maintaining the accessibility of the debt agreement system for higher income debtors with a greater capacity to repay their debts.

Note however, that the reforms also provide an option for debtors to propose payments that exceed the payment to income ratio percentage if the source of the debtor’s proposed payments is viable. The proposed debt agreement administrator will be required to certify the viability of such proposals and to be satisfied that the debtor is likely to discharge their obligations under the agreement.

Doubling of the assets threshold

The reforms also broaden the scope of debtors who are eligible to lodge a debt agreement proposal by doubling the assets threshold amount. Currently, a debtor is prevented from giving the Official Receiver a debt agreement proposal if, at the proposal time, the value of the debtor’s property that would be divisible among creditors if the debtor were bankrupt (assets threshold) is more than the threshold amount.

Do the reforms limit the length of debt agreements?

Yes. The reforms prevent a debtor from proposing a debt agreement that would last longer than three years from the day the agreement is made. The rule will also apply to proposals to vary an agreement, so a variation cannot have the effect of extending the timeframe for making payments under the agreement beyond three years from the original agreement date.

If a debtor has not satisfied the obligations created by the agreement three years after the agreement is made, the agreement will continue until it terminates, ends or otherwise concludes under Part IX of the Bankruptcy Act 1966 (the Bankruptcy Act).

However, debtors who own or have equity in their principal place of residence will be able to propose a debt agreement length of up to five years, and these debtors will also be exempt from the requirement to comply with the payment to income ratio (above).

Further, certain debtors will be able to vary their debt agreement to up to five years if they suffer a substantial and unforeseen change in circumstances that is likely to prevent them from completing the debt agreement. If a debtor does vary their debt agreement for this reason, the variation must not increase the total value of payments originally agreed to.

Do the reforms change the Official Receiver’s power to reject a debt agreement proposal?

Yes. The reforms provide that the Official Receiver can refuse to accept a debt agreement proposal for processing if the Official Receiver reasonably believes that complying with the debt agreement would cause undue hardship to the debtor.

Under the Bankruptcy Act, an administrator is already required to certify that the debtor is likely to be able to discharge the obligations created by the agreement as and when they fall due. This certification, in addition to the Bill’s new requirement for a debt agreement proposal to satisfy a prescribed payments to income ratio (see above), will already prevent most agreements that would cause the debtor undue hardship. Accordingly, it would only be in exceptional circumstances that the Official Receiver would be called upon to consider whether to exercise this discretion not to send the debt agreement proposal to affected creditors for voting. For example, the Official Receiver may exercise this discretion when facts have been brought to its attention which create a reasonable belief in the mind of the Official Receiver satisfying the requisite statutory standard that the debtor would experience ‘undue hardship’.

This proposed change will also apply to proposals to vary a debt agreement. For both original and varied debt agreements, the power is discretionary and will not require the Official Receiver to review every request.

Will the reforms affect creditor voting rules?

Yes. Under the reforms, the Official Receiver must not request a vote from an administrator that is an affected creditor, or from a related entity to the administrator. This applies to proposals to enter into, vary or terminate a debt agreement.

A separate amendment in the Bill will make it an offence for an administrator to give, agree, or offer to give an affected creditor an incentive for voting a certain way on a debt agreement proposal, or on a variation or termination proposal.

Will the reforms affect arrears notification requirements?

Three month arrears notifications

Yes. For debt agreements that come into force on or after 27 June 2019, an administrator is only required to notify creditors of a three month arrears default where the amount of arrears is over a threshold. The threshold is either:

- The total amount that the debtor was in arrears exceeds $300, or 20% of the total of all of the due payments at the beginning of the three month period – whichever is higher; or

- If the total of all of the due payments was $300 or less, no payment was made in that period to reduce any of the due payments

For debt agreements that come into force before 27 June 2019, there is no threshold.

A three month “test time” will begin when a debtor misses a payment. Three months from this date, an administrator looks back over the past three month period and determines whether or not the arrears since the beginning of this “test time” has exceeded the threshold.

It is important to remember that a three month arrears default will occur if the debtor was in arrears over the entire three month period and is in excess of the threshold at the end of the three month period.

Where the arrears is rectified by the end of the three month “test time”, an administrator is not required to notify creditors. Administrators should refer to IGPD 17 - Guidelines relating to administrator's duty to notify creditors of 3 month arrears for further information.

Six month arrears notifications

No. There are no changes to the requirements to send six month arrears default notifications. Current guidance on six month arrears default notifications can be found at IGPD 16 - Guidelines relating to administrator’s duty to notify the Official Receiver of 6-month arrears default.

What do administrators now need to have in place to be eligible to practice?

A debt agreement administrator is now required to obtain and maintain adequate and appropriate professional indemnity and fidelity insurance, similar to the requirements imposed on registered trustees under the Bankruptcy Act. This will be a requirement for applications for registration or renewal made on or after 27 June 2019.

Professional advice should be sought as to what is “adequate and appropriate” insurance for your business.

An administrator’s insurance will be checked when an individual or company applies for registration or renewal of their registration. Regulation may also check compliance as part of their Insolvency Compliance Program. Failure to obtain or maintain this insurance is a ground for cancellation of registration or an offence if intentional or reckless. The other new requirement for administrators is to meet a fit and proper test. This applies to individuals, corporate administrators and directors of corporates. This will be tested at registration and failure to meet this standard at any time can be used as a ground to seek cancellation of registration.

What other changes will result from the reforms?

Other changes include:

- Making registration as a debt agreement administrator mandatory so that only a registered debt agreement administrator, registered trustee or the Official Trustee can administer a debt agreement;

- Expressly prohibiting a debtor from self-administering their own debt agreement;

- Requiring debt agreement administrators to disclose the details of any broker or referrer relationships, including the details of any payments made;

- Requiring debt agreement administrators to disclose whether any affected creditors on a debt agreement proposal are a related entity of the administrator;

- Where a variation to an agreement is proposed, requiring the administrator to certify that the debtor is likely to be able to discharge the obligations created by the agreement (as proposed to be varied) as and when they fall due;

- Consistent with the requirements placed on bankruptcy trustees, requiring an administrator to consider whether the debtor has committed any offences under the Bankruptcy Act and, if so, to refer the conduct to the Inspector-General in Bankruptcy or to relevant law enforcement authorities;

- Introducing new offences in relation to an administrator that gives, or agrees or offers to give valuable consideration (such as cash payments) to an affected creditor to influence their vote on a debt agreement proposal, variation or termination. This is to prevent misconduct that would give advantage to some parties at the expense of others.

- Introducing new offences in relation to the administration of trust accounts and the keeping of proper books to ensure alignment between the bankruptcy and debt agreement offence regimes;

- Amending the description and characteristics of offences contained in the BADAR and the Bankruptcy Act to ensure they are consistent with standards in the Criminal Code Act 1995 and the Guide to Framing Commonwealth Offences, Infringement Notices and Enforcement Powers;

- Allowing the Attorney-General to make legislative instruments for the purposes of determining industry wide conditions for registered debt agreement administrators, to be determined in consultation with industry groups and stakeholders;

- Providing that the Inspector-General’s investigation and inquiry powers extend to any conduct of a registered debt agreement administrator. This amendment will allow the Inspector-General to investigate or inquire into the debt agreement administrator’s conduct during the period starting from when the debt agreement administrator and debtor first engage. It will also allow the Inspector-General to investigate or inquire into any other conduct of a debt agreement administrator, including their advertising practices.

- Changes to the forms the debtors and administrators are required to submit to AFSA.

When did the new legislation commence?

The key reforms in the Bankruptcy Amendment (Debt Agreement Reform) Act 2018 commenced on 27 June 2019.

What changes are being introduced by the legislative instrument signed by the Attorney-General?

The Bankruptcy (Registered Debt Agreement Administrator Conditions) Determination 2020 will introduce a number of industry wide conditions for all registered debt agreement administrators, including standards relating to:

- Advertising and promotion of the services of registered debt agreement administrators – whether done by, or on behalf of, an administrator

- Information disclosed to debtors before they sign a debt agreement proposal – including what information must be provided to a debtor and the requirement that the information is ‘factual and objective’

- Requirements for obtaining membership with the Australian Financial Complaints Authority

When will the industry wide conditions apply to registered debt agreement administrators?

They will apply to all registered debt agreement administrators from 1 January 2021 onwards.

I’m a POMR at a company administrator, will I need to obtain membership to the Australian Financial Complaints Authority (AFCA)?

Every registered debt agreement administrator must be a member of AFCA from 1 January 2021.

The only exception is if:

- You are a person with overall management responsibility, carrying on debt agreement activities in the name of and on behalf of a company debt agreement administrator; and

- That company debt agreement administrator is a member of AFCA.

I am a POMR for more than one company administrators, would each company administrator need to obtain membership to AFCA?

Yes. The industry-wide condition requires each registered administrator (including a company administrator) to become a member of AFCA (with the exception that a POMR is not required to obtain AFCA membership). This means that each company administrator for which a person is a POMR must have AFCA membership.

What will happen to debt agreements being administered by unregistered debt agreement administrators or the debtors themselves?

All debt agreements being administered by a debtor or an unregistered administrator will default to be administered by the Official Trustee on 27 September 2019. Debtors are encouraged to consider selecting and appointing a registered debt agreement administrator prior to this time.

How do I comply with the new disclosure requirements under the legislative instrument?

The Bankruptcy (Registered Debt Agreement Administrator Conditions) Determination 2020 (legislative instrument) details new disclosure requirements where an RDAA will be required to provide a debtor certain information in two stages:

- Stage 1 Information – an RDAA must provide information required under subsection (3) of the legislative instrument, either orally or in writing using an approved form, to a debtor at least 5 business days before a debt agreement proposal is signed; and

- Stage 2 Information – after complying with providing stage 1 information, an RDAA must provide information required under subsection (4) of the legislative instrument. This must be in writing using an approved form, to a debtor at least 1 business day before a debt agreement proposal is signed.

To help comply with the new disclosure requirement, an Additional Information sheet has been created and published on the AFSA website: https://www.afsa.gov.au/insolvency/how-we-can-help/forms/additional-information-sheet-debt-agreements. Depending on whether the form is used for Stage 1 or 2 Information, the RDAA can check a box to indicate if the fees set out in the document are estimates or a final calculation.

In order to comply with the new disclosure requirements, it is expected that RDAAs will apply one of the two options listed below:

Option 1:

- Stage 1 Information – The RDAA verbally provides the information listed under subsection (3) of the legislative instrument at least 5 business days before a debtor signs a debt agreement proposal. The RDAA must make a record of this information as per subsection (6) and (7) of the legislative instrument.

- Stage 2 Information – The RDAA provides the information listed under subsection (4) of the legislative instrument by providing the Prescribed Information and Additional Information sheet (with checkbox “final” ticked to indicate fees are a final calculation) to the debtor at least 1 business day before a debtor signs a debt agreement proposal. The RDAA retains this on file as per subsection (6) and (7) of the legislative instrument.

Option 2:

- Stage 1 Information – The RDAA provides the information listed under subsection (3) of the legislative instrument by providing the Prescribed Information and Additional Information sheet (with checkbox “estimate” ticked to indicate fees are an estimate) at least 5 business days before a debtor signs a debt agreement proposal. The RDAA retains this on file as per subsection (6) and (7) of the legislative instrument.

- Stage 2 Information – The RDAA provides the Prescribed Information and Additional Information sheet (with checkbox “final” ticked to indicate fees are a final calculation) to the debtor at least 1 business day before a debtor signs a debt agreement proposal. The RDAA retains this on file as per subsection (6) and (7) of the legislative instrument.

Related documents

Bankruptcy Amendment (Debt Agreement Reform) Act 2018 Table of amendments