On this page

-

Introduction

- The purpose of this practice document is to outline the process by which trustees of a regulated debtor’s estate may apply to the Inspector-General in Bankruptcy[1] to have their remuneration determined when it has not been determined or approved by creditors or the committee of inspection.

- This practice document has been updated to reflect amendments to the Bankruptcy Act 1966 introduced by the Insolvency Law Reform Act 2016 (“the ILRA”) and the Insolvency Practice Rules (Bankruptcy) 2016 (“the Rules”) from 1 September 2017.

- It should be noted that, despite the repeal of former sections 161B and 162 of the Bankruptcy Act from 1 September 2017, those provisions[2] continue to apply to remuneration of trustees who were appointed, or consented to act, before 1 September 2017.

- A basic principle of the personal insolvency regime is that creditors (as the ordinary cost bearers) should have primary control over remuneration in the administration of a regulated debtor’s estate. However, there are circumstances where:

- it may not be practical or cost-effective for the trustee to seek creditors’ approval of remuneration

- the trustee and creditors disagree about the amount of remuneration sought, or

- none of the creditors vote in respect to a trustee’s proposal for remuneration.

In all of these circumstances, rather than having an impasse delaying the administration, trustees can apply to AFSA for determination of their remuneration.

- If trustees seek to claim remuneration above the statutory amount which does not require creditor approval,[3] they must have the full amount of their proposed remuneration determined by creditors (or the committee of inspection).

- The remuneration determination process applies both to trustees of:

- a regulated debtor’s estate who are appointed, or consented to act, on or after 1 September 2017[4] – under section 60-11 of the Insolvency Practice Schedule (Bankruptcy) (“the Schedule”; Schedule 2 of the Bankruptcy Act) and section 60-5 of the Rules

- a bankruptcy, composition, section 188 authority and personal insolvency agreement who are appointed, or consented to act, before 1 September 2017 – under former section 162(4) of the Bankruptcy Act and former regulations 8.09 – 8.11 of the former Bankruptcy Regulations 1996 (“the former Regulations”).

- This practice document does not apply to the Official Trustee in Bankruptcy’s remuneration. The Official Trustee is remunerated as determined by the Minister by legislative instrument and does not require approval by creditors.[5]

-

Circumstances in which a trustee may apply to the Inspector-General for a remuneration determination

- In order for AFSA to consider an application for a remuneration determination, the trustee will need to satisfy AFSA that one or more prescribed circumstances exist[6] and provide appropriate supporting evidence that either:

- creditors or the committee of inspection have rejected, or failed to vote, on a proposal to determine remuneration (at a meeting of creditors or by proposal without a meeting)

- it is not cost-effective to seek creditor approval (e.g. it may not be cost-effective where the value of the assets in the estate is so small that the expense of holding a creditors’ meeting or submitting a proposal without a meeting is impractical or cannot be justified), and/or

- it is not practical to seek creditor approval (for example, it may not be practical to seek creditor approval where the only creditor in the estate has had their debt paid such as an owners’ corporation after the sale of a strata title property).

-

Form of the application

- The application for remuneration determination must be made in either of the following ways, depending upon when the trustee was appointed or consented to act.

-

On or after 1 September 2017:

- The application must be in the approved form and include supporting evidence as required. The approved from (Form 39) is available for trustees on the AFSA website. The application must:

- identify which of paragraphs 60-5(b) or (c) of the Rules the trustee believes is satisfied and include relevant evidence

- contain a single proposal about the trustee’s proposed remuneration

- explain why:

– any work already performed by the trustee was necessary

– any work proposed to be performed by the trustee will be necessary

– the proposed remuneration for the work, or proposed work, is appropriate for the particular administration - contain details of complexity of work that was or is likely to be complex

- contain details of extraordinary issues of work that includes or is likely to include those issues

- include a copy of any notices given by the trustee to the creditors relating to remuneration, such as an Initial Remuneration Notice or Remuneration Approval Report.

Before 1 September 2017:

- The application must be in writing and include supporting evidence as required. A recommended administrative form (Form 29) is available for trustees on the AFSA website. The application must:[7]

- state which of the prescribed circumstance(s) under former regulation 8.09 of the former Regulations applies and provide evidence

- contain a single proposal capable of being approved by the Inspector-General

- explain why:

– any work already performed by the trustee was necessary

– any work proposed to be performed by the trustee will be necessary

– the proposed remuneration for the work, or proposed work, is appropriate for the particular administration - contain evidence of the trustee’s statement to the creditors under former subsections 64U(5) and 64U(5A) of the Bankruptcy Act if applicable

- include a copy of any notices issued by the trustee to the bankrupt/debtor and creditors under former subsection 162(6A) of the Bankruptcy Act.

- In order for AFSA to consider an application for a remuneration determination, the trustee will need to satisfy AFSA that one or more prescribed circumstances exist[6] and provide appropriate supporting evidence that either:

-

Assessing a trustee’s application

- Where the trustee’s application complies with the requirements in paragraph 2.2 above, the Inspector-General will proceed with determining remuneration, taking into account the following.

-

Trustees appointed on or after 1 September 2017:[8]

- the extent to which the work by the trustee was necessary and properly performed

- the extent to which the work likely to be performed by the trustee is likely to be necessary and properly performed

- the period during which the work was, or is likely to be, performed by the trustee

- the quality of the work performed, or likely to be performed, by the trustee

- the complexity (or otherwise) of the work performed, or likely to be performed, by the trustee

- the extent (if any) to which the trustee was, or is likely to be, required to deal with extraordinary issues

- the extent (if any) to which the trustee was, or is likely to be, required to accept a higher level of risk or responsibility than is usually the case

- the value and nature of any property dealt with, or likely to be dealt with, by the trustee

- the number, attributes and conduct, or the likely number, attributes and conduct, of the creditors

- if the remuneration is worked out wholly or partly on a time-cost basis – the time properly taken, or likely to be properly taken, by the trustee in performing the work

- whether the trustee has followed the procedure in the Schedule to the Act and the Rules for estimating remuneration, including whether the trustee has adequately described to creditors the work performed or to be performed

- whether the trustee has given the regulated debtor and the creditors the notices required to be given under the Rules

- and any other relevant matters.

Trustees appointed before 1 September 2017:[9]

- whether the trustee has followed the procedure contained in former section 64U or 64ZBA of the Act for estimating remuneration, including adequately describing to creditors the work performed or to be performed

- whether the trustee has given the required notices to the bankrupt and creditors concerning remuneration, required to be given under the Regulations and former regulations

- whether the trustee has explained why the work performed or to be performed was or is likely to be necessary

- whether, taking into account the nature and complexity of the work, the proposed remuneration is commensurate with:

– the work already performed, or

– the work proposed to be performed - any other relevant matters.

- Further information about the factors which may be taken into account by AFSA when deciding the remuneration is available in:

- The matters considered by AFSA will vary depending on the circumstances under which the application is made. For example, if the trustee has satisfied AFSA that it is not cost effective or practical to seek creditors’ approval, it will not be necessary for AFSA to consider whether the trustee has followed the procedure for convening a meeting of creditors or a proposal with a meeting. However, it is expected that in such a case the trustee will provide AFSA with the information the trustee would have otherwise been required to provide to the creditors.

- The reference to “any other relevant matters” in paragraph 60-15(m) of the Rules and the former paragraph 8.11(f) of the former Regulations may include (but is not limited to) some or all of the following:

- whether the remuneration proposal, if it has been put to creditors for a vote, was rejected and the how the votes were cast

- whether the trustee has a high rate of rejection of remuneration proposals by either creditors or the Inspector-General

- where the proposal has been rejected, whether the trustee attempted to negotiate a lower amount with creditors that they would be willing to accept. This may involve seeking approval for a lesser amount than was originally sought.

- whether sufficient time was given to creditors to vote on the remuneration proposal

- whether if a remuneration proposal was sent to creditors without a meeting, there was any follow up with creditors to elicit a response

- whether the amount the trustee is seeking approval for is materially different to the estimate given in the initial remuneration notice

- for retrospective approval, whether it is apparent that work has been performed unnecessarily or improperly or that charging is unreasonable.

- Essentially, AFSA will be concerned to ensure that the trustee has followed the correct procedure in estimating their remuneration and explaining the basis of the estimate, along with the correct procedure for notifying creditors and the bankrupt/debtor of the rates and methods of the proposed remuneration. It will not be within AFSA’s remit to consider the reasonableness of the trustee’s hourly (or other time-based) rate, although this may be something that creditors consider when voting on remuneration. If a proposal is rejected, the trustee may have to demonstrate to AFSA that they have attempted to negotiate an amount that is acceptable to creditors.

- Also, AFSA should be satisfied that the proposal includes only the remuneration for work that is likely to be necessary and reasonable and (before deciding to undertake the work) the trustee has compared the cost likely to be incurred with the value and complexity of the administration. The trustee’s application to AFSA must explain why the proposed remuneration for the work performed or work yet to be performed is appropriate for the particular administration.

- It will be open to AFSA to:

- approve the amount for which the trustee has sought approval, or

- reject the amount the trustee has sought approval for and either:

- – substitute a lesser amount than the amount for which the trustee has sought approval, or

- – make no substitution (with the effect that remuneration remains unapproved).

- AFSA may seek further information before deciding the application. Section 12 of the Bankruptcy Act provides for the making of inquiries and investigations as the Inspector-General thinks fit with respect to the administration of or the conduct of a trustee in relation to (among other things) a bankruptcy, composition, scheme of arrangement, controlling trusteeship or personal insolvency agreement. This function will enable AFSA to seek from the trustee any additional information required to decide the trustee’s application.

- In the event that AFSA does not agree with the amount of remuneration sought by the trustee, a lesser amount than that which is sought may be approved. If such a situation arises, AFSA will inform the trustee of that proposed decision and give the trustee an opportunity to bring any further matters to AFSA’s attention before the making the determination.

-

Timeframe for assessing an application

- AFSA will acknowledge the application within 5 business days and endeavour to make a decision on the trustee’s application within 20 business days. This timeframe may be extended if AFSA requires further information from the trustee.

-

Effect of the determination

- The trustee is entitled to draw remuneration once it is determined by AFSA, in accordance with the terms of the approval.

- However, trustees should be aware that the amount they are entitled to claim from the estate may be reduced following a review conducted by AFSA under Subdivision C of Division 90 of the Schedule, even if the total amount claimed is within the amount approved by the creditors or determined by AFSA.

- This is consistent with the general principle that trustees are only entitled to reasonable remuneration for work that is necessary and is properly performed.

-

Advising parties of the determination

- Written notice of AFSA’s decision will be given to the trustee, the bankrupt/debtor and the creditors. In the event that the application is not approved, the trustee may choose to put a revised remuneration proposal to creditors or seek to vacate the office by the methods provided in Division 5 of Part VIII of the Bankruptcy Act (resignation under section 180 or replacement by another trustee nominated under section 181A) and the Schedule (replacement by creditors under section 90-35).

- Before notifying creditors of the decision, AFSA will contact the trustee to establish the correct list of creditors in the event that the trustee became aware of additional creditors that were not disclosed by the bankrupt/debtor on their statement of affairs.[10]

- Creditors who are dissatisfied with a decision of AFSA to approve a trustee’s remuneration application may consider removing the trustee and appointing another registered trustee.

-

Right of review

- There is no right to seek a review by the Administrative Appeals Tribunal (“AAT”) in relation to the various decisions that can be made by AFSA under section 60-5 of the Rules or former section 162(4A) of the Bankruptcy Act. However, judicial review by the Federal Court or Federal Circuit and Family Court may be sought pursuant to the Administrative Decisions (Judicial Review) Act 1977.

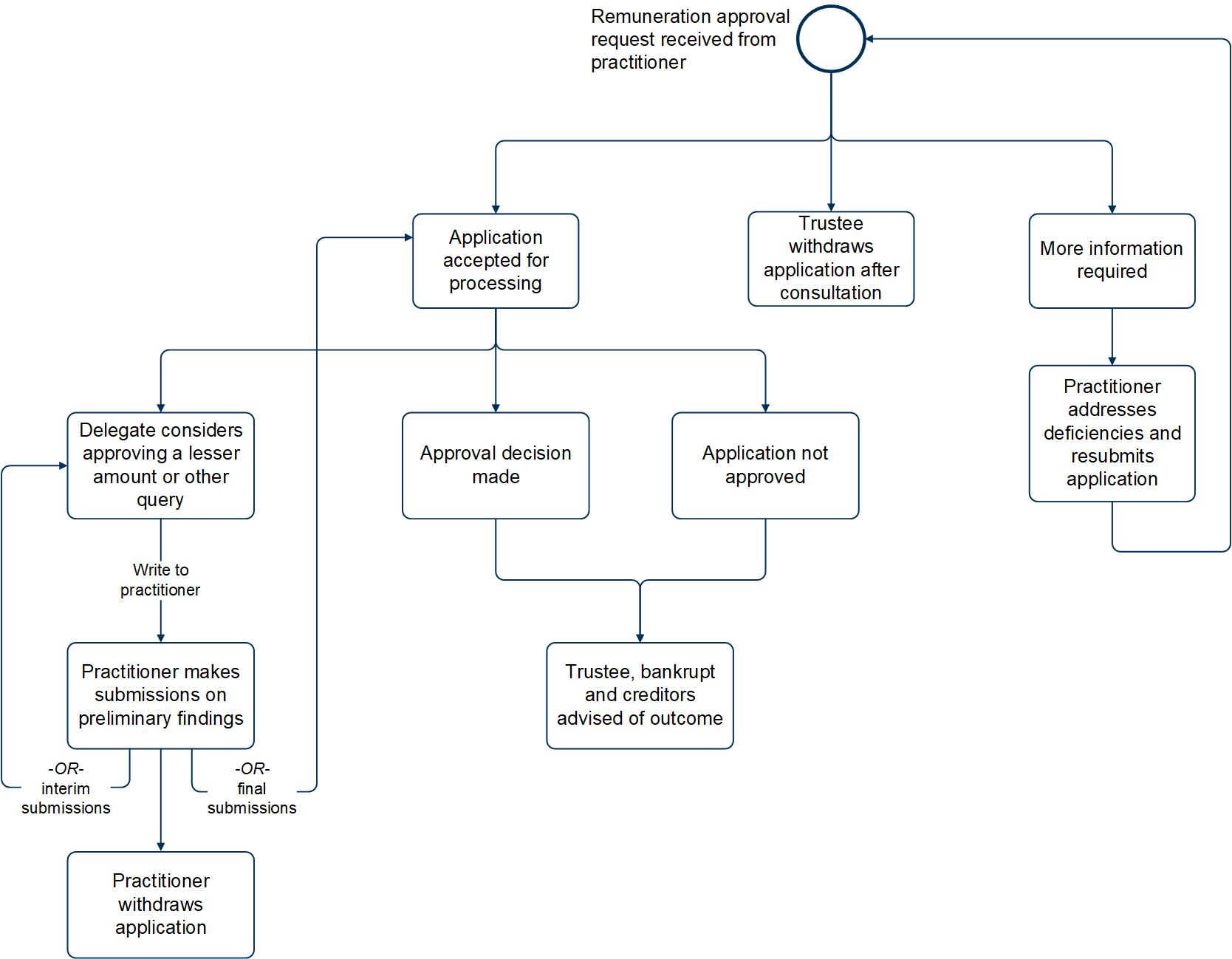

- Annexure A contains a flowchart of the process relating to approval of remuneration.

Annexure A – Trustee Remuneration Determination Process

Footnotes

[1] The powers of the Inspector-General are delegated to officers in AFSA’s Enforcement and Practitioner Surveillance division

[2] Other than former subsections 162(5A), (6) and (6A) of the Act

[4] Item 128 of Schedule 1 of the ILRA

[5] See section 163 the Bankruptcy Act, Part 3 of the Bankruptcy (Fees and Remuneration) Determination 2015 and AFSA’s fees and charges webpage

[6] For trustees appointed on or after 1 September 2017, see paragraphs 60-5(b) and (c) of the Rules. For trustees appointed before 1 September 2017, see former regulation 8.09 of the former Regulations

[7] Former regulation 8.10 of the former Regulations

[8] Section 60-15 of the Rules

[9] Former regulation 8.11 of the former Regulations

[10] From 1 January 2020, the debtor's petition and statement of affairs were combined into the Bankruptcy Form. The Bankruptcy Form is also used by a person made bankrupt via sequestration order, in place of the former statement of affairs. References in this guidance document to a statements of affairs can be taken to also refer to the Bankruptcy Form